Unlike term life insurance which is temporary and limited to a predetermined number of years whole life will last your entire lifetime and pay out the benefit upon your death. The premiums are fixed although an upfront.

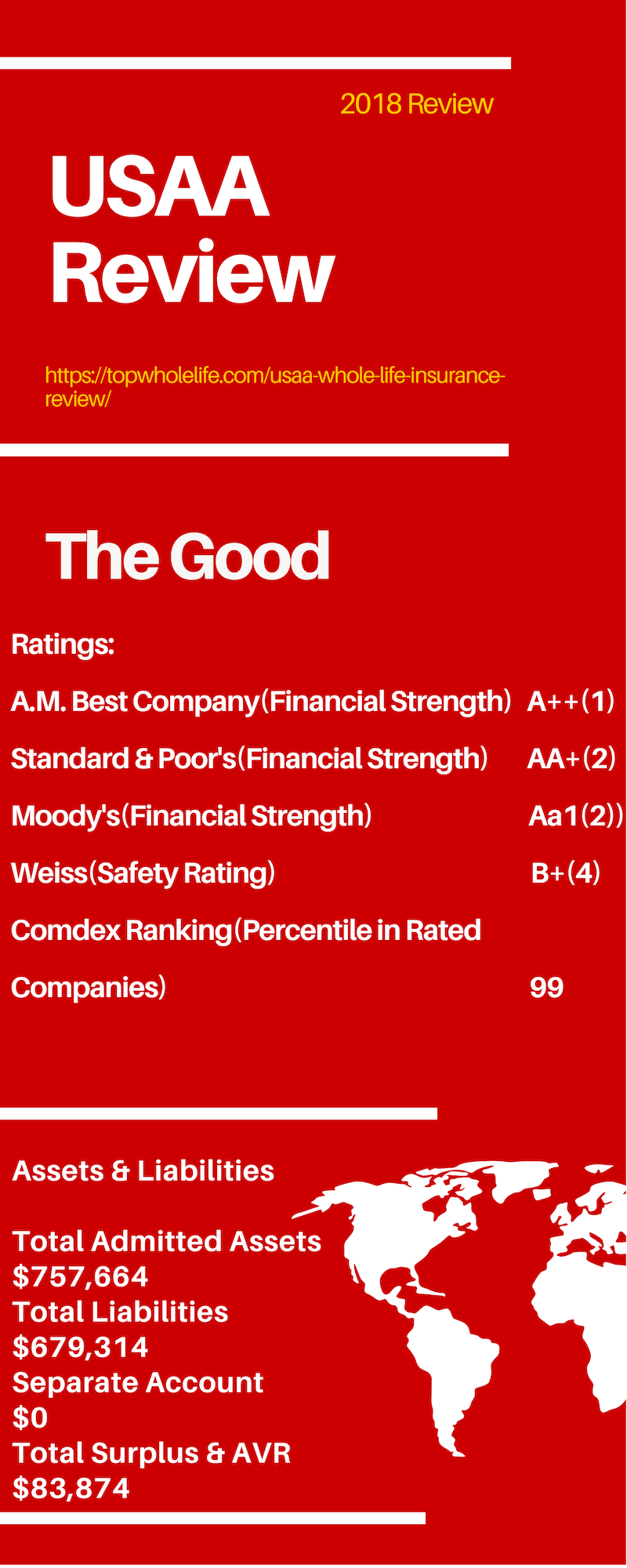

Usaa Whole Life Insurance Review Not Your Best Whole Life

Usaa Whole Life Insurance Review Not Your Best Whole Life

We asked three certified financial planners whether whole life insurance is a smart way to round out your overall investment strategy.

Is whole life insurance good. If youve been around the life insurance industry for more than five minutes its pretty likely that youve encountered all sorts of reasons as to why whole life insurance is bad. Whole life insurance is often sold as a kind of cure all investment with built in tax advantages and flexibility to help you handle just about any need. A few days ago we set out to find the absolute dumbest arguments against whole life.

The pitch will sound good. It is not an investment account and as such is handled differently. One part of the policy is the insurance coverage.

But the truth is that whole life insurance is a poor fit for just about everyone with significant weaknesses that are all too often hidden by the agents selling these policiesread more. In fact its probably the most maligned of any financial product. With whole life insurance after a number of years some of the money youve paid is yours to keepeven if you stop paying premiums.

Learn about the costs and other key details associated with investing in whole life insurance. Whole life insurance a type of permanent life insurance is actually a hybrid insurance and investment product in one. This is called the policys cash value.

It will sound like youre getting a guaranteed return with little to no downside risk and that the money will be available for just about anything you want at any time. The real benefits of whole life insurance take time but just like the old proverb good things come to those who wait whole life insurance needs time to be effective. Whole life insurance as an investment.

Whole life insurance might be worth it as an investment if youve already maxed out your retirement accounts and have a diversified portfolio but only if you need for permanent life insurance coverage. At some point in your life you will almost certainly be pitched the idea of life insurance as an investment. At insurance estates we help you make sound estate planning and wealth building decisions and sometimes this involves taking a closer look at the little known money secrets of the wealthy.

Because whole life insurance is just that life insurance. Ill talk about whole life insurance here but understand that where i say whole this could apply to a universal policy as well.

Whole Life Insurance Compare Whole Life Insurance Quotes Instantly

Whole Life Insurance Compare Whole Life Insurance Quotes Instantly

Metlife Life Insurance In 2020 A Comprehensive Review

Metlife Life Insurance In 2020 A Comprehensive Review

Top 20 Best Whole Life Insurance Companies In 2020

Top 20 Best Whole Life Insurance Companies In 2020

![]() Whole Life Insurance Guaranteed Death Benefit And Premiums

Whole Life Insurance Guaranteed Death Benefit And Premiums

Is Whole Life Insurance A Good Investment The Roi Illusion

Is Whole Life Insurance A Good Investment The Roi Illusion

Should You Trust Trustage With Life Insurance An Eye Opening Review

Should You Trust Trustage With Life Insurance An Eye Opening Review

Whole Life Insurance And Why People Choose It

Whole Life Insurance And Why People Choose It

What Are Whole Life Insurance Plans Tips Advice Local Khabar

What Are Whole Life Insurance Plans Tips Advice Local Khabar

Whole Life Insurance How It Works

Whole Life Insurance How It Works

Whole Life Insurance Definition And Meaning Market Business News

Whole Life Insurance Definition And Meaning Market Business News

How Does Whole Life Insurance Work Financial Sumo

How Does Whole Life Insurance Work Financial Sumo

The Differences Between Term Life Insurance And Whole Life

The Differences Between Term Life Insurance And Whole Life

What Is Whole Life Insurance Emma Ca

What Is Whole Life Insurance Emma Ca

Paid Up Life Insurance Explained The Insurance Pro Blog

Paid Up Life Insurance Explained The Insurance Pro Blog

Find The Best Whole Life Insurance

Find The Best Whole Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

3 Reasons Why Whole Life Insurance Is A Good Idea My Family Life

3 Reasons Why Whole Life Insurance Is A Good Idea My Family Life

Search Q Universal Life Insurance Tbm Isch

Term Life Insurance And Whole Life Insurance Quotes For Your Family

Term Life Insurance And Whole Life Insurance Quotes For Your Family

Search Q Term Life Policy Tbm Isch

Seven Tips For Buying Whole Life Insurance Wealth Nation

Seven Tips For Buying Whole Life Insurance Wealth Nation

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Famers Whole Life Insurance Review Not Your Best Bet

Famers Whole Life Insurance Review Not Your Best Bet