The most basic choice you must make is whether to purchase term life insurance or whole life insurance. Individuals above 40 years of age are advised to purchase whole life insurance.

Whole Or Term Life Insurance The Definitive Guide

Whole Or Term Life Insurance The Definitive Guide

When you buy life insurance you have many choices to make.

Is term life insurance better than whole life insurance. Term insurance vs whole life insurance. She also suggested i get them from different insurance companies. Compare cost and policy features.

Is term life insurance better than whole life. Why term life insurance is better than whole life insurance last updated on june 2 2019 robert farrington 28 comments this article contains references to products from one or more of our advertisers. When i met with our financial advisor one of the first things she suggested was to get term life insurancenot whole life insurance.

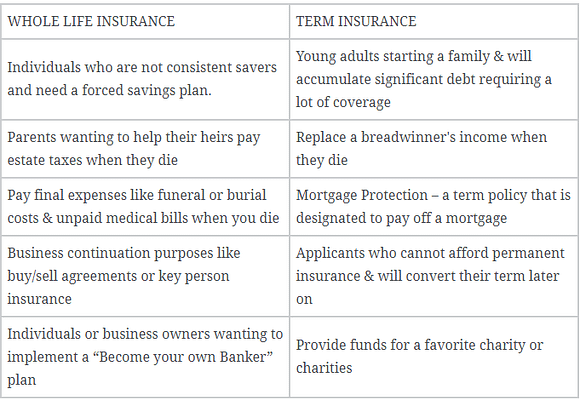

No matter what type of insurance you choose here are some basic definitions you need to know. Now that you have a better picture of the difference between term and whole life policies you probably want to compare term life versus whole life insurance costs. Each type of policy has its own uses and advantages as well as disadvantages.

There are differences between term and whole life insurance but some concepts are the same across types. While term life insurance may not necessarily be better than whole life insurance term is definitely the right choice of coverage in most situations. Policyholder the owner of the life insurance policy.

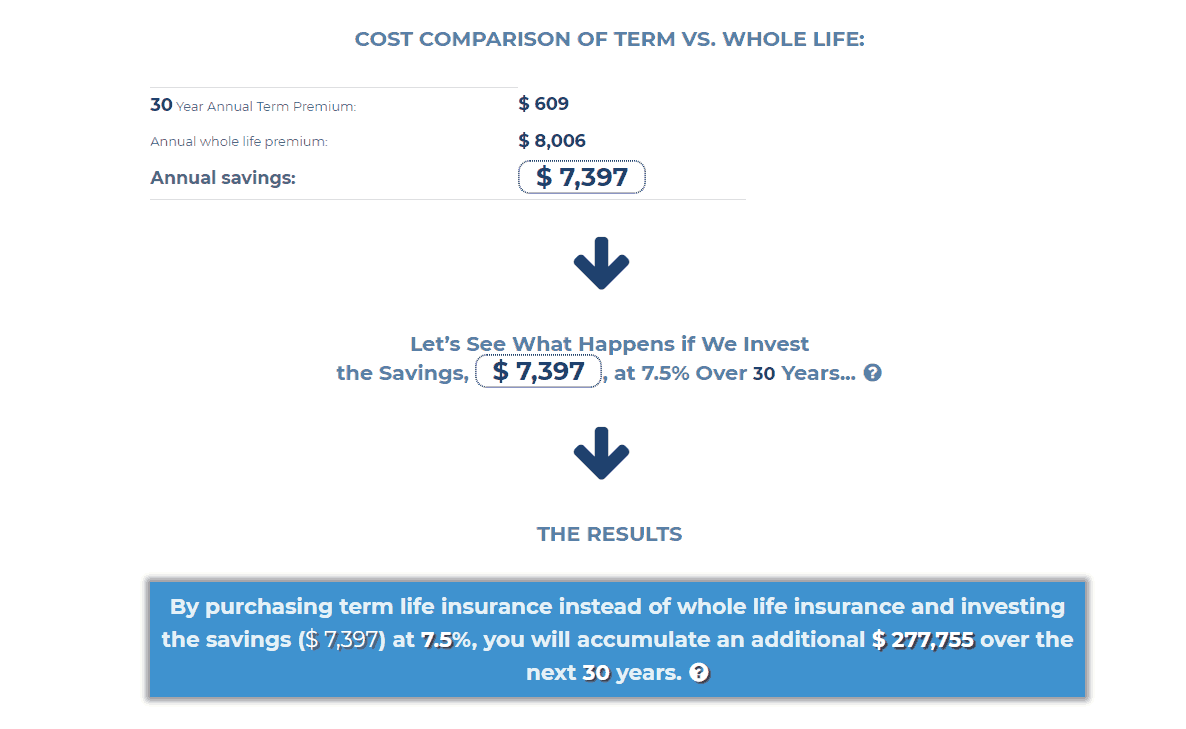

Make sure you understand the. Whats funny is that it was the same advice i once received from our business accountant. Whole life insurance costs more because it lasts a lifetime and does have cash value.

Term life insurance is cheap because its temporary and has no cash value. Prior to writing this i did some research on the topic to see what was readily available for consumers. Such individuals have more liabilities in the form of spouse and children so there is need for both financial security and life protection.

How to compare term life and whole life side by side. Because the cost of term life insurance tends to be less than a whole life policy with a similar death benefit it can be an inexpensive way to temporarily get a large death benefit for your family. A term life insurance policy covers you for a specified time period and only provides you with a death benefit if you die within that time frame.

For the vast majority of people term life insurance is a much better choice than whole life insurance and i am going to show you why. Permanent coverage whole life being the most well known lasts your entire life. Common term whole life insurance definitions.

Term life insurance is coverage that lasts for a specific period of time. The high premium is the only concern of customers when buying whole life insurance.

Whole Life Insurance For Diabetics The Better Choice Than Term

Whole Life Insurance For Diabetics The Better Choice Than Term

Whole Life Insurance Cash Value Chart

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

Whole Life Vs Term Life Insurance What S The Best Option

Whole Life Vs Term Life Insurance What S The Best Option

Term Life Insurance Versus Whole Life Insurance Which Is More

Term Life Insurance Versus Whole Life Insurance Which Is More

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Difference Between Whole Life And Term Life Insurance With

Difference Between Whole Life And Term Life Insurance With

Term Insurance Vs Whole Life Insurance What To Choose

Term Insurance Vs Whole Life Insurance What To Choose

Learning English In Ohio Term Vs Whole Life Insurance

Learning English In Ohio Term Vs Whole Life Insurance

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Term Versus Whole Life Insurance

Term Versus Whole Life Insurance

Whole Life Insurance What You Need To Know

Whole Life Insurance What You Need To Know

Term Vs Whole Life Insurance Csc Insurance Options

Term Vs Whole Life Insurance Csc Insurance Options

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Term Vs Whole Life Insurance Which Is Better With Infographics

Term Vs Whole Life Insurance Which Is Better With Infographics

Individual Life Insurance Vs Group Term Life Insurance

Individual Life Insurance Vs Group Term Life Insurance

Life Insurance Quote Instant Insurance Quote

Life Insurance Quote Instant Insurance Quote

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

Why Is Term Insurance Better Than Whole Life Insurance Youtube

Why Is Term Insurance Better Than Whole Life Insurance Youtube

How Does Life Insurance Work What Is It Term Whole Life Universal

How Does Life Insurance Work What Is It Term Whole Life Universal

Everything You Need To Know About 10 Year Term Life Insurance

Everything You Need To Know About 10 Year Term Life Insurance

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide