Is life insurance part of estate if you are looking for low cost insurance then our online insurance quotes service will help you find a provider that works for you. Is life insurance part of estate if you are looking for the best insurance then our insurance quotes service can give you options to find a plan you are happy with.

Life Insurance And Estate Planning Alexandria Capital

Life Insurance And Estate Planning Alexandria Capital

Life insurance as a component of an estate.

Is life insurance part of estate. Life insurance proceeds are not part of your estate. Even if there is no money whatsoever to pay bills the insurance is not part of the. The distinction matters because the estate assets can be used to pay the outstanding debts of the deceased and larger estates are subject to estate tax.

If someone else owns the policy the benefit will not be included in your estate. Dont wait any longer. If the life insurance policy in question has one or several designated beneficiaries and one of those designated beneficiaries is alive at the time of the decedents death that individual receives the life insurance proceeds.

Many times people do not name everything they own in their wills. They go directly to the beneficiary and are their property. If at least one of the designated beneficiaries survives the decedent the life insurance proceeds pass directly to the beneficiary outside of probate.

Even if there is no money whatsoever to pay bills the insurance is not part of the. Your daughter can do whatever she wants with the proceeds. Is life insurance part of estate if you are looking for a fast free insurance quote then get reliable information from a trusted provider.

When life insurance is part of an estate a life insurance policy has one or more designated beneficiaries if the decedent completed a beneficiary designation form for the policy before their death. Life insurance is not considered part of an estate and is not available to pay the decedents bills and debts. Life insurance is not considered part of an estate and is not available to pay the decedents bills and debts.

It does not matter if it is included in a will or not. If you own a life insurance policy on yourself the death benefit will be part of your estate. Life insurance is only part of an estate if the policy is not left to a designated beneficiary.

A person might bequeath some of his assets to certain beneficiaries and simply state that he gives the. Life insurance is not required to be used to pay the debts of the estate.

Estate Planning Should I Leave My Life Insurance To My Estate

Estate Planning Should I Leave My Life Insurance To My Estate

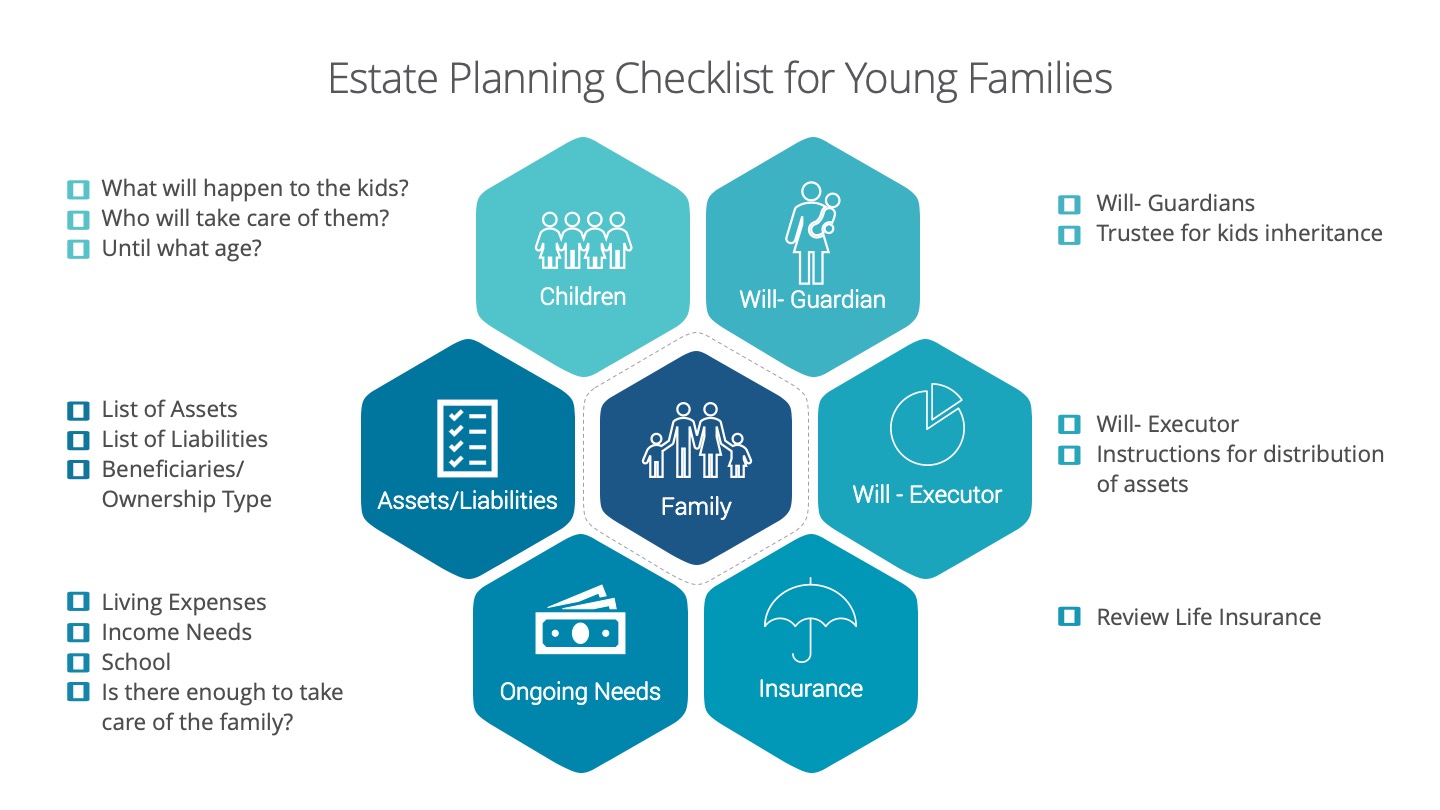

Estate Planning For Young Families

Estate Planning For Young Families

Three Pitfalls To Avoid When Naming A Beneficiary Of A Life

Three Pitfalls To Avoid When Naming A Beneficiary Of A Life

Crypto Millionaires And The Estate Planning Quandary Using

The Role Of Life Insurance In Your Estate Plan Modern Woodmen

The Role Of Life Insurance In Your Estate Plan Modern Woodmen

Is Life Insurance Part Of A Person S Estate Quora

Is Life Insurance Part Of A Person S Estate Quora

Life Insurance As Part Of An Estate When To Use A Will Or Trust

Life Insurance As Part Of An Estate When To Use A Will Or Trust

Errors To Avoid In Using Life Insurance For Estate Planning

Errors To Avoid In Using Life Insurance For Estate Planning

Is Payment Of Life Insurance Part Of Estate

Is Payment Of Life Insurance Part Of Estate

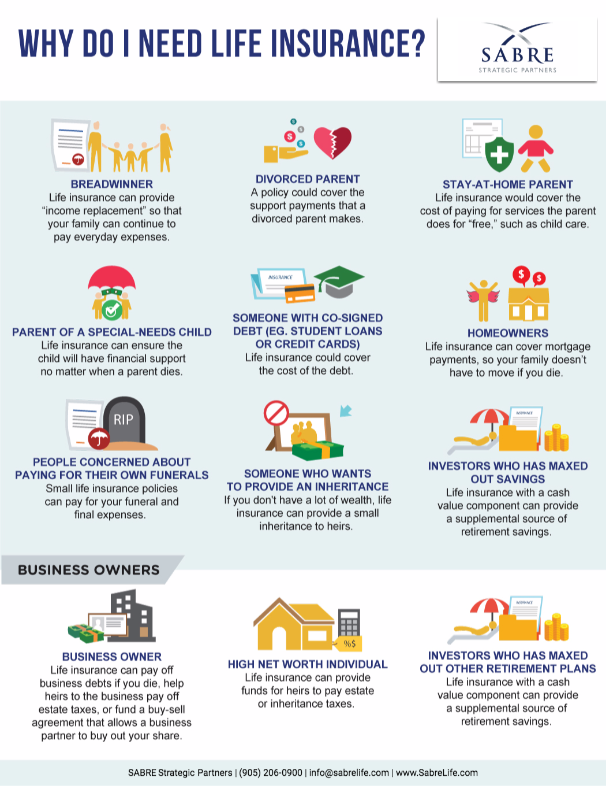

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

Life Insurance Can Be A Powerful Estate Planning Tool For

Life Insurance Can Be A Powerful Estate Planning Tool For

Life Insurance Philippines Educational Plans Mutual Funds

Life Insurance Philippines Educational Plans Mutual Funds

Life Insurance Long Term Care Planning

Life Insurance Long Term Care Planning

Ironhorse Wealth Management Estate Planning Life Insurance

Ironhorse Wealth Management Estate Planning Life Insurance

Top 10 Considerations For Estate Planning With Life Insurance

Top 10 Considerations For Estate Planning With Life Insurance

Beneficiary Designation Estate Planning Lawyer Legacy Design

Beneficiary Designation Estate Planning Lawyer Legacy Design

Try This Estate Planning Tip To See Bigger Picture Briaud

Try This Estate Planning Tip To See Bigger Picture Briaud

The Importance Of Life Insurance In Estate Planning Advisors To

The Importance Of Life Insurance In Estate Planning Advisors To

Life Insurance And Estate Planning West Des Moines Lawyer

Life Insurance And Estate Planning West Des Moines Lawyer

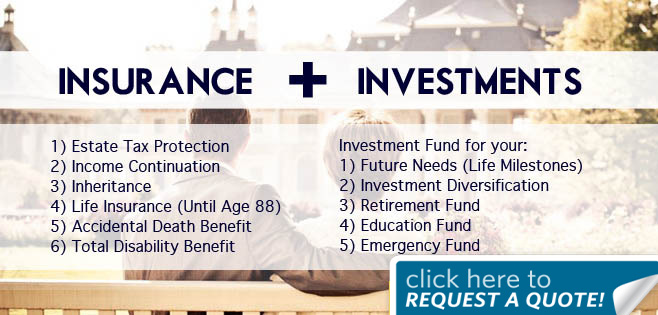

Estate Planning Using Life Insurance Moneytalkph

Estate Planning Using Life Insurance Moneytalkph

Life Insurance In Estate Planning Summit Planners Estate Planning

Life Insurance In Estate Planning Summit Planners Estate Planning