To be more specific if you have at the time of your death an incidence of ownership in the policy the proceeds will be considered part of your estate. Many times people do not name everything they own in their wills.

Life Insurance As An Estate Planning Tool For Foreign Nationals

Life Insurance As An Estate Planning Tool For Foreign Nationals

Then it may.

Is life insurance included in estate. Life insurance and the gross estate of the insured tax facts experts answer questions like. Life insurance is only part of an estate if the policy is not left to a designated beneficiary. A life insurance plan is a good thing to have in place when you are planning for your estate.

Is life insurance included in an estate. When life insurance is part of an estate a life insurance policy has one or more designated beneficiaries if the decedent completed a beneficiary designation form for the policy before their death. The amount of the estate that is over the exempt amount is subject to the federal and state estate taxes for that state.

Is answered free by a licensed agent. 1 payable to or for the benefit of the decedents estate or 2 payable to any other beneficiary but only if the decedents possessed incidents of ownership practical power directly or indirectly to control the existence of the policy to rearrange the economic. The death benefits paid on life insurance policies are subject to estate tax in two situations.

When you die this plan can be included in the value of your estate. It does not matter if it is included in a will or not. If at least one of the designated beneficiaries survives the decedent the life insurance proceeds pass directly to the beneficiary outside of probate.

First if the death benefit is paid to the estate of the insured then the whole amount of the death benefit is included in the estate and subject to estate tax. A person might bequeath some of his assets to certain beneficiaries and simply state that he gives the. It can be combined with the cost of everything else you own to add up to an estimated total.

Life insurance policies are included in your taxable estate. Whether the proceeds from your life insurance policy end up in your estate or not depends on who owns and controls the policy. If you own the policy the proceeds will be added to your estate.

Yes life insurance is included in estate tax if the money is not passed to a surviving spouse and the beneficiary is not an irrevocable life insurance trust. Proceeds of life insurance policies on the decedents life are includable in the gross estate if the proceeds are. Dominics estate is worth about 45.

Most people dont need to worry about estate taxes but if you you should know that the proceeds from a life insurance policy that you buy on your own life will be included in your taxable estate and will be subject to estate taxes. What benefits payable at death are included in the term life insurance for estate tax.

Life Insurance Can Be A Powerful Estate Planning Tool For

Life Insurance Can Be A Powerful Estate Planning Tool For

Are Life Insurance Proceeds Subject To Estate Tax

Are Life Insurance Proceeds Subject To Estate Tax

Using Life Insurance And Irrevocable Trusts To Provide Liquidity

Using Life Insurance And Irrevocable Trusts To Provide Liquidity

What S An Irrevocable Life Insurance Trust And Why Do I Need One

What S An Irrevocable Life Insurance Trust And Why Do I Need One

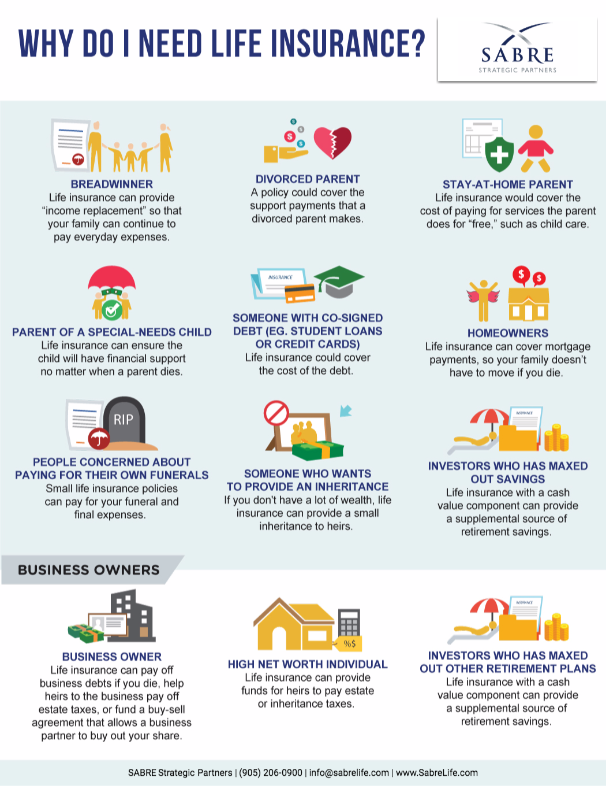

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

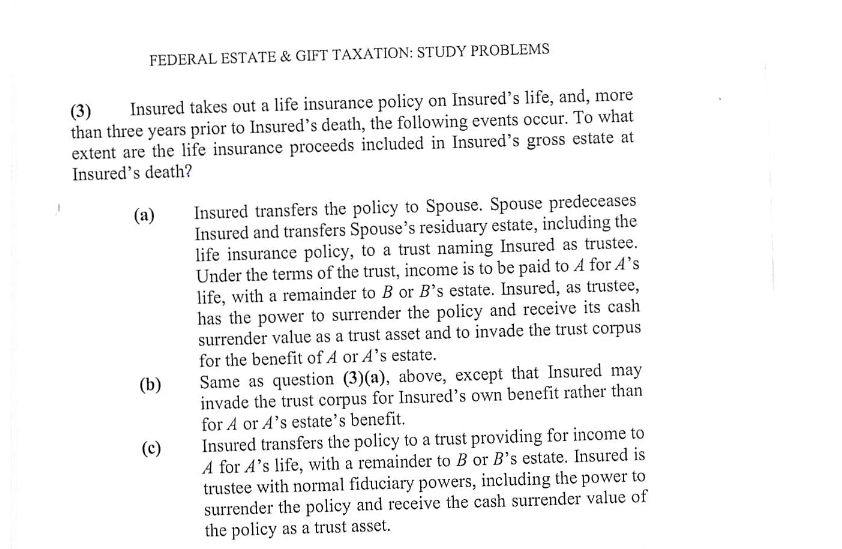

Federal Estate Gift Taxation Study Problems 3 Chegg Com

Federal Estate Gift Taxation Study Problems 3 Chegg Com

Understanding Life Insurance Trusts Estateplanning Com

Understanding Life Insurance Trusts Estateplanning Com

Estate Planning Using Life Insurance Moneytalkph

Estate Planning Using Life Insurance Moneytalkph

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Chapter X Life Insurance In Estate Planning A Timber Taxes

Chapter X Life Insurance In Estate Planning A Timber Taxes

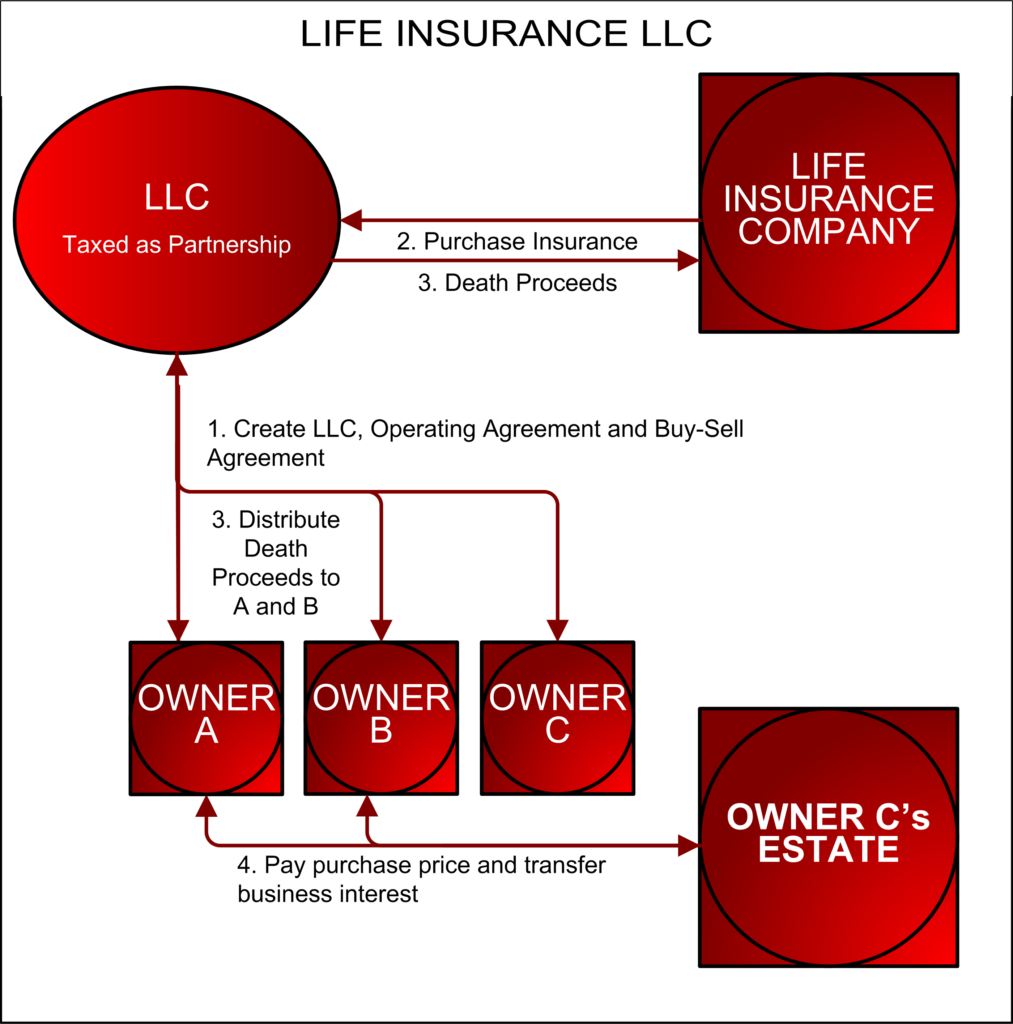

The Life Insurance Llc A Potential Solution To The Buy Sell Tax

The Life Insurance Llc A Potential Solution To The Buy Sell Tax

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Life Insurance Estate Planning

Life Insurance Estate Planning

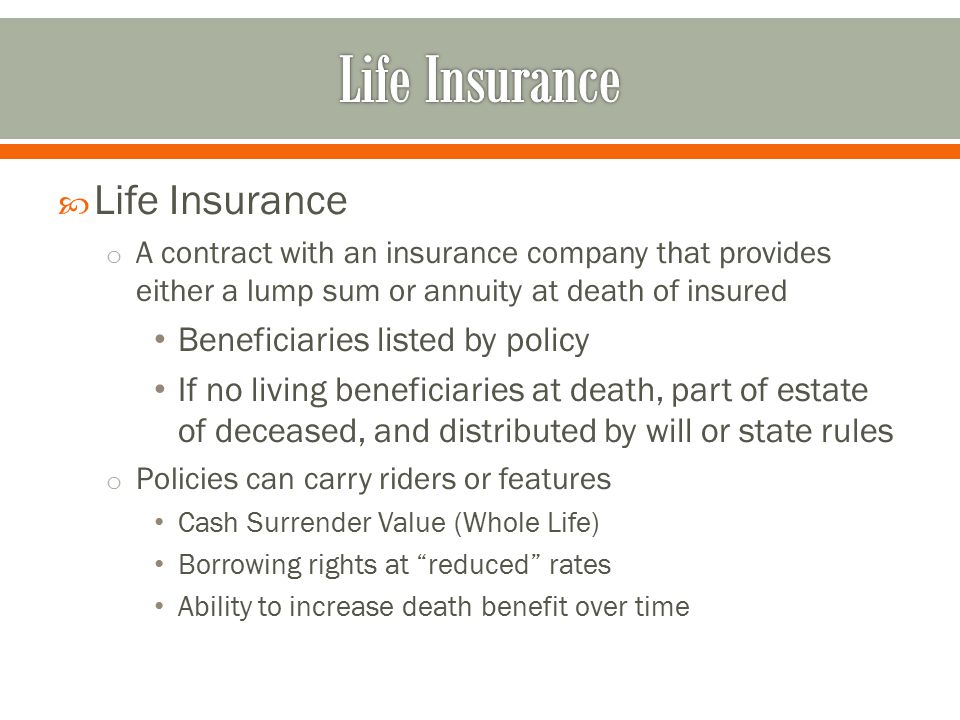

Life Insurance In Estate Planning Ppt Video Online Download

Life Insurance In Estate Planning Ppt Video Online Download

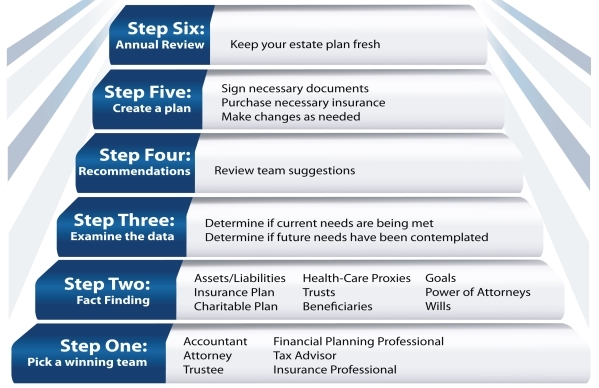

Estate Planning Tips Sun Life Financial Philippines

Estate Planning Tips Sun Life Financial Philippines

Life Insurance And Your Estate Plan

Life Insurance And Your Estate Plan

Do Life Insurance Policies Form Part Of An Estate In Ontario

Do Life Insurance Policies Form Part Of An Estate In Ontario

Life Insurance And Estate Planning Medchi Insurance Agency

Life Insurance And Estate Planning Medchi Insurance Agency

Life Insurance In Estate Planning Global Investment Strategies

Life Insurance In Estate Planning Global Investment Strategies

Life Insurance Will Always Matter With Or Without The Estate Taxes

Life Insurance Will Always Matter With Or Without The Estate Taxes

Asset Protection Archives Law Office Of Alexandria Goff Pc

Asset Protection Archives Law Office Of Alexandria Goff Pc

How Life Insurance Can Be A Useful Estate Planning Tool Infinity

How Life Insurance Can Be A Useful Estate Planning Tool Infinity