Of course you can always check out the hmrc website for the latest information key man insurance taxation. You may need to purchase insurance on your own life or the life of your business partner to fund a buy sell agreement but another type of coverage that should always be considered is key man insurance.

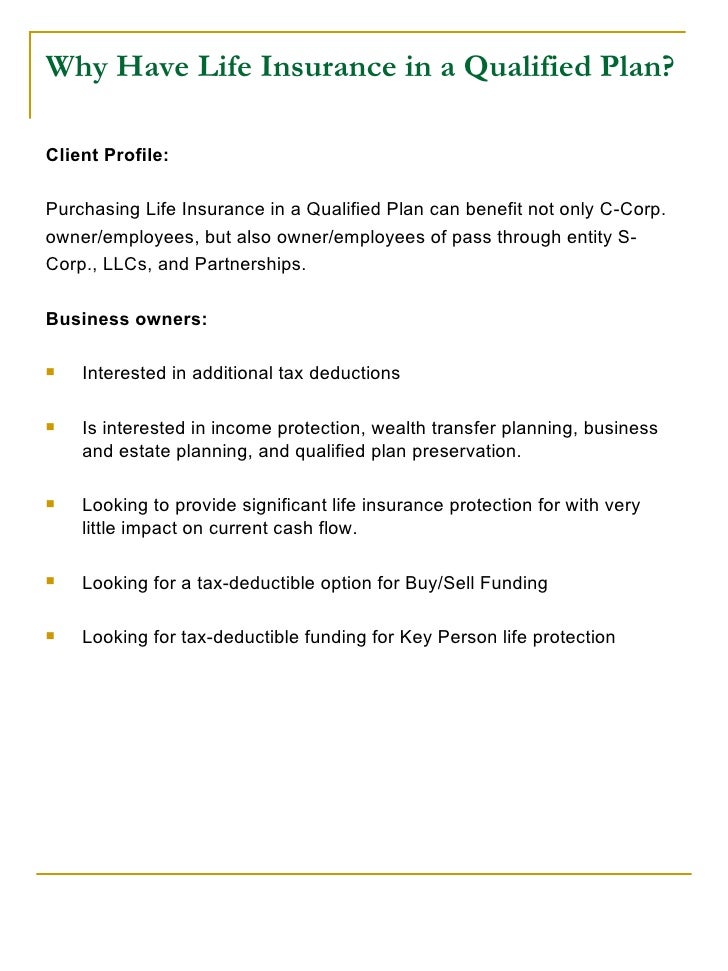

Why Have Life Insurance In A Qualified Plan

Why Have Life Insurance In A Qualified Plan

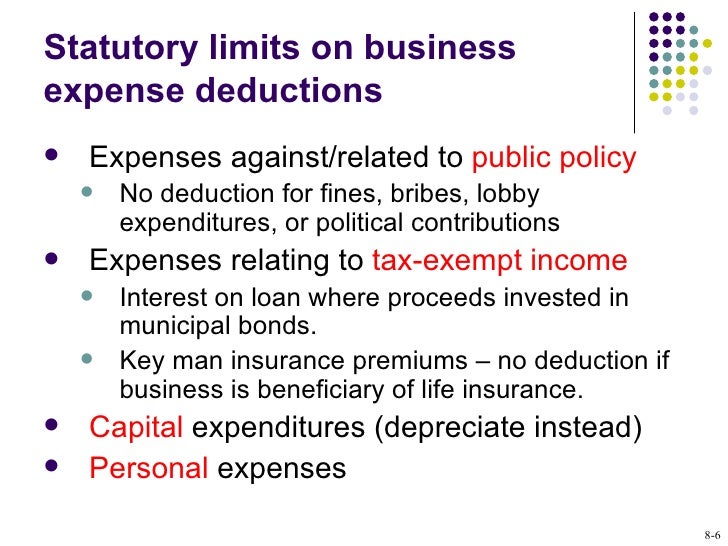

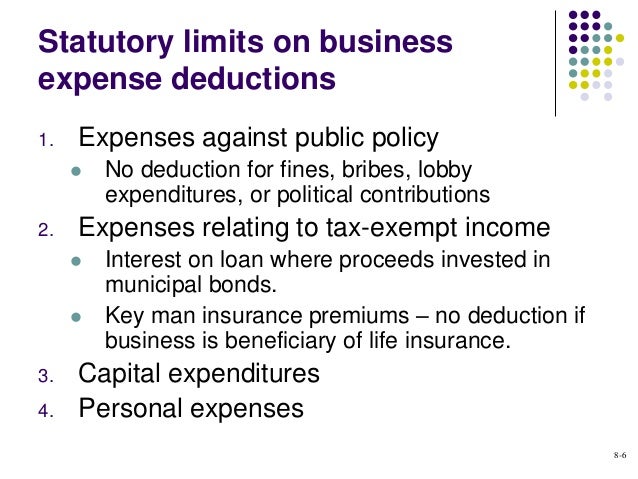

Keyman life insurance is not tax deductible to the business owner who took out the policy on a key employee if the business owner or the business is the beneficiary of the policy.

Is key man life insurance tax deductible. Key person insurance may only be tax deductible is the premiums are being charged to the individual that is covered through taxable income. In some instances the premiums on a key man policy can declared as a tax deduction by the company but only if those premiums are charged to the insured individual as taxable income. The term key man insurance is used in the industry to denote insurance on the life of a director partner employer or other key person associated with the taxpayer in business.

Key man insurance is a crucial type of protection that could be the difference between closure and keeping a business open. Although this may be unfavorable for the key man being covered some companies offer these employees incentives to keep them on board. Premiums must be paid with after tax dollars.

For those people who are looking for a personal tax efficient life insurance you may want to consider a relevant life policy or just give us a call on 020 7112 8844. The pension protection act of 2006 and the taxation of key man insurance. Furthermore key man insurance and other employer owned life insurance is specifically covered under section 1264 1a and states the premiums paid for life insurance on the life of any officer employee or person financially interested in a business carried on by the taxpayer are not deductible where the taxpayer is directly or indirectly a.

Your company can only deduct key man insurance premiums if theyre considered to be part of the employees taxable income in which case the employee is typically the beneficiary. Key man insurance policies and tax consequences relating thereto introduction. The types of policies involved are whole of life endowment term or temporary life assurance sickness and accident insurance.

If the key person policy is provided to a key employee and the beneficiary is not the business or business owner the premiums may be tax deductible. On august 17 2006 president george bush signed tax legislation containing provisions which have widespread implications for key man and other employer owned life insurance purchased after august 17 2006. Typically the cost of key man life insurance is not tax deductible.

A number of companies and close corporations choose to conclude insurance policies over the lives of the directors of the business to ensure the financial stability of the business in the event of the unexpected death of the key person concerned. Tax treatment of key man life insurance. The company not the individual insured owns the policy and is the named beneficiary.

Key man life insurance is typically sold as an equity building whole life policy.

Relevant Life Policy Hmrc Tax Treatment 2019

Relevant Life Policy Hmrc Tax Treatment 2019

/GettyImages-472338783-5b6de658c9e77c0050b0a945.jpg) Does Your Business Need Key Person Insurance

Does Your Business Need Key Person Insurance

Csf Business Uses Of Life Insurance Csf Traditional Applications U

Csf Business Uses Of Life Insurance Csf Traditional Applications U

Types Of Life Insurance Policygenius

Types Of Life Insurance Policygenius

Fresh Competitive Life Insurance Quotes Lifecoolquotes

Fresh Competitive Life Insurance Quotes Lifecoolquotes

Can I Claim Life Insurance As A Business Expense Life Ant

Can I Claim Life Insurance As A Business Expense Life Ant

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

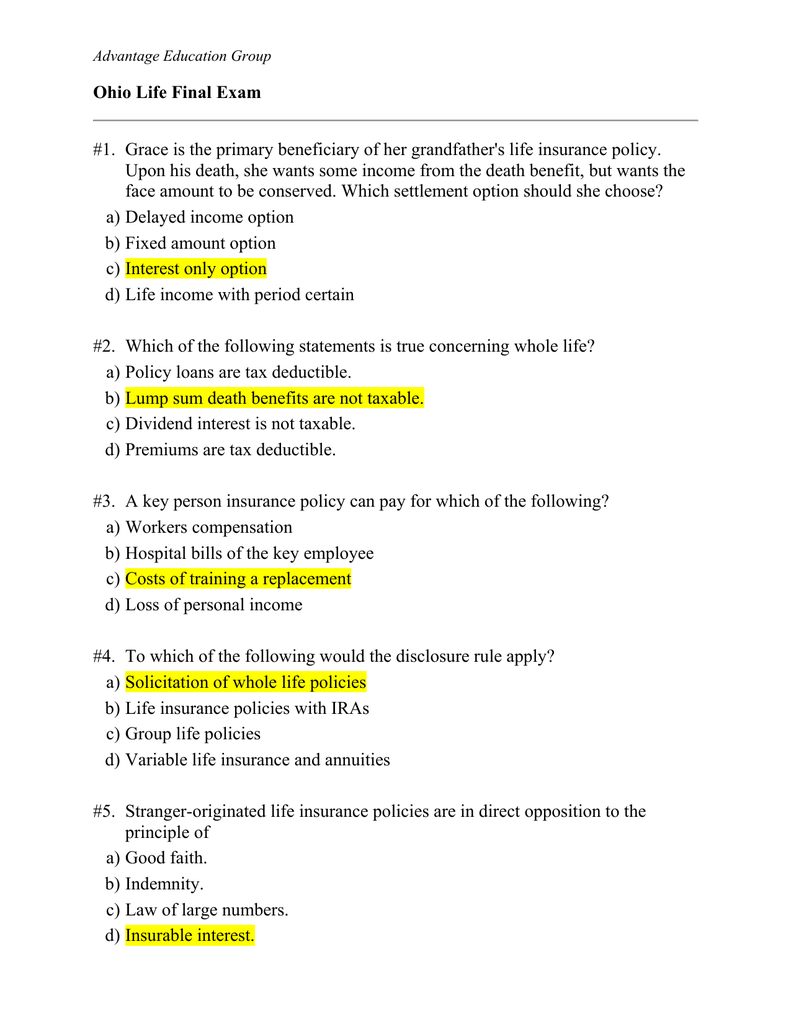

Ohio Life Final Exam Advantage Education Group Take Pages

Ohio Life Final Exam Advantage Education Group Take Pages

Is Life Insurance Tax Deductible In Australia Iselect

Is Life Insurance Tax Deductible In Australia Iselect

Carmen Venter Workshops For Cfp Examinations Pdf Free Download

Carmen Venter Workshops For Cfp Examinations Pdf Free Download

Https Www Sunnet Sunlife Com Files Advisor English Pdf Are Insurance Premiums Deductible Pdf

Keyman Insurance Ppt Video Online Download

Keyman Insurance Ppt Video Online Download

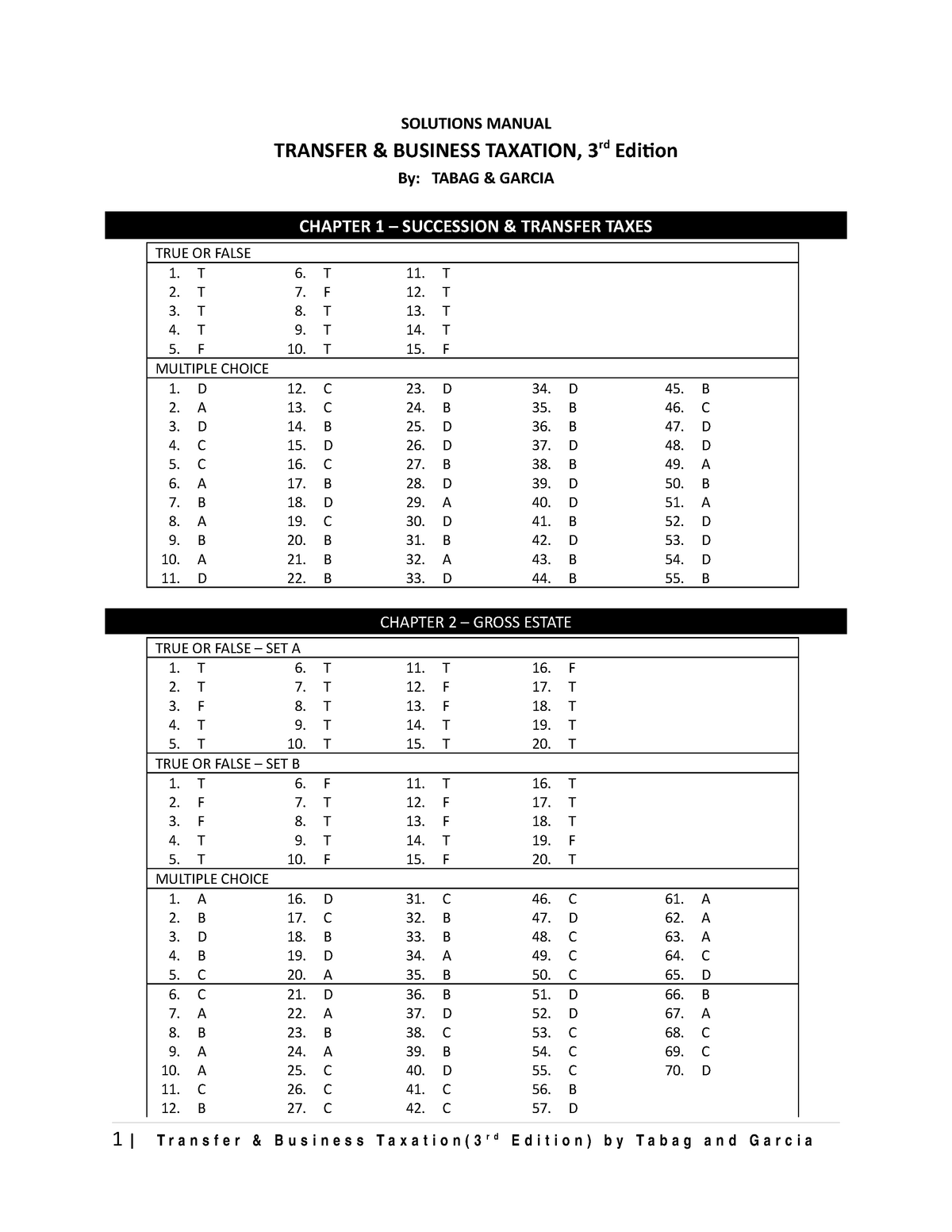

Transfer Business Taxation Tabag Garcia 3rd Edition Studocu

Transfer Business Taxation Tabag Garcia 3rd Edition Studocu

Key Man Insurance Policies Vs Buy And Sell Agreements Which Is

Key Man Insurance Policies Vs Buy And Sell Agreements Which Is

/GettyImages-173047189-5acfeef643a1030037e4f191.jpg) Corporate Owned Life Dead Peasant Insurance

Corporate Owned Life Dead Peasant Insurance

How Keyman Insurance Can Help Protect The Life Of A Business The

How Keyman Insurance Can Help Protect The Life Of A Business The

Key Man Life Insurance And Tax Deductions Einsurance

Key Man Life Insurance And Tax Deductions Einsurance

Save Income Tax Best Tax Saving Option For Fy 2018 19 Here S A

Save Income Tax Best Tax Saving Option For Fy 2018 19 Here S A

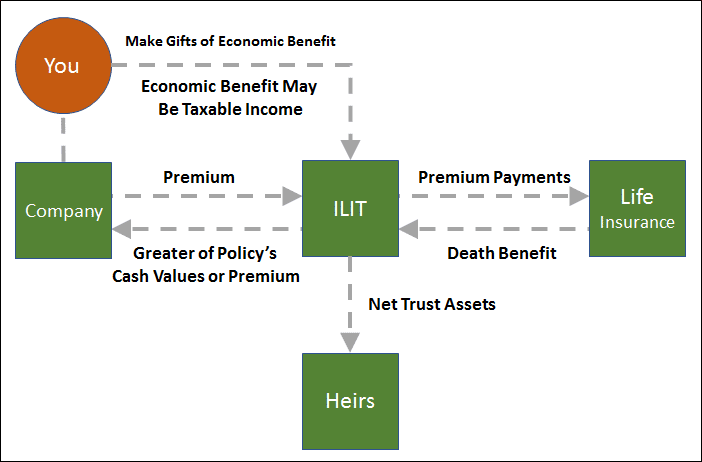

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

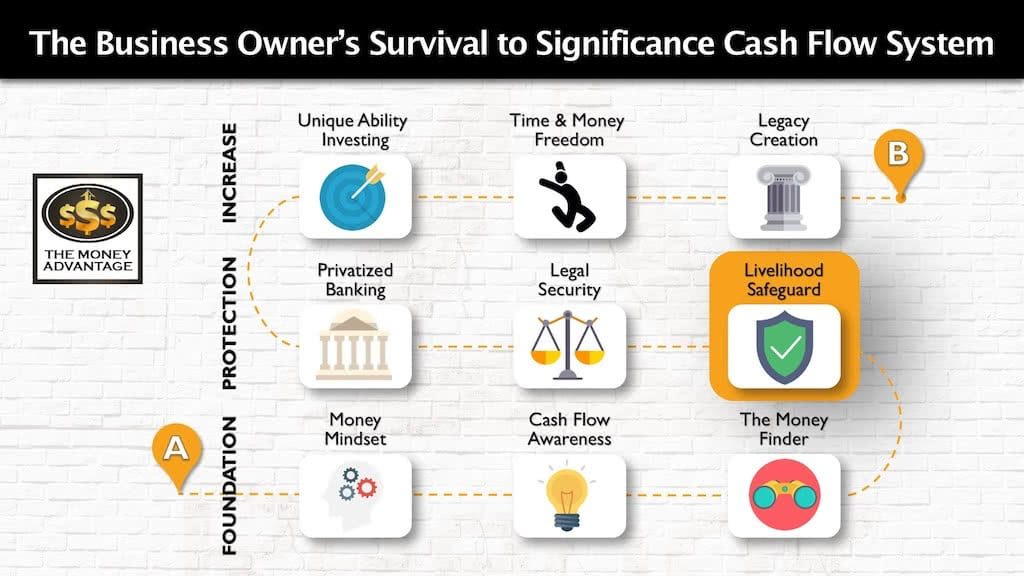

Key Man Insurance Protecting Your Business Profits And Livelihood

Key Man Insurance Protecting Your Business Profits And Livelihood