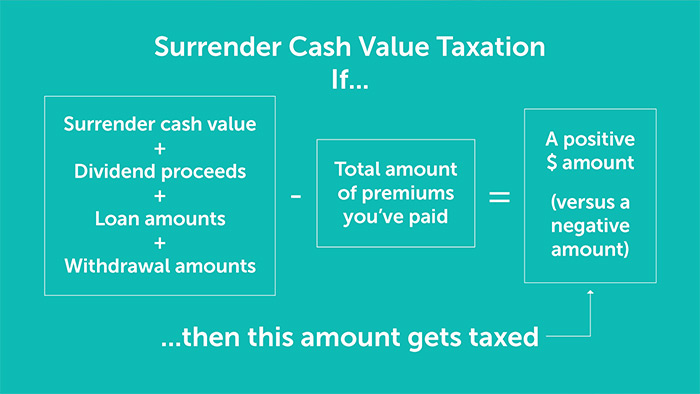

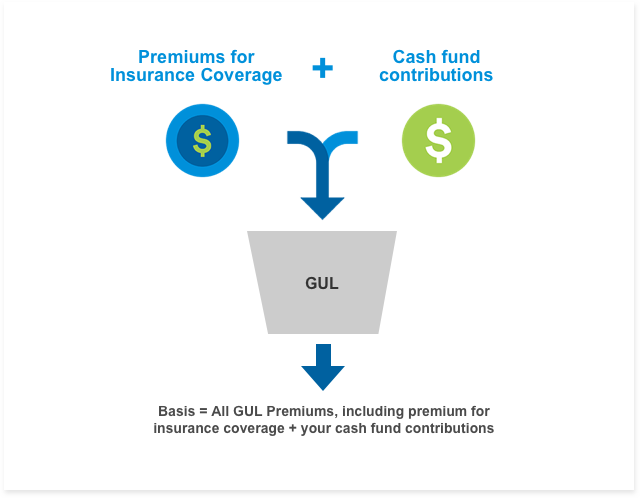

For example lets say over 20 years you paid 1000 per year totaling 20k. Basis is considered the premium you paid in.

All proceeds or withdrawals from any insurance policy are not taxable this is not true.

Is cash value of life insurance taxable. Each policy has a. How to calculate taxable income when cashing out life insurance pre death. In this example the cash value is 35k.

Cash value accumulation deferred taxes wendy owns a universal life insurance policy that earns 4000 in interest this policy year. Most of the time proceeds arent taxable. But there are certain.

If you cancel a life insurance policy the growth on the cash value is taxable. Life insurance contracts must meet irs requirements. The cash surrender value in life insurance is only taxable on the amount over your basis.

A life insurance policy is similar to a savings account. Your whole life or variable life insurance policy could be a source of cash while youre still alive. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away.

You can do this by notifying your life insurance carrier that you would like to take money out of your policy. The most direct way to access the cash value in your policy is to make a withdrawal from it. The insurance company will cancel your policy and mail you a check for your account balance.

Because the interest earnings remain inside the life insurance policy wendy will not owe taxes on the 4000 interest earnings on her cash surrender value. Tax implications for the cash surrender of life insurance if your life insurance policy has cash value you can take out your money whenever you want through a cash surrender. The gain on the surrender of a cash value policy is the difference between the gross cash value paid out plus any loans outstanding and your basis in the policy.

For federal income tax purposes an insurance contract cannot be considered a life insurance contract and qualify for favorable tax treatment unless it meets state law requirements and satisfies the irss statutory definitions of what is or is not a life insurance policy. You deposit money into the life insurance policy in the form of premiums the insurer uses a portion of your deposits to pay for the life. If you surrender your cash value life insurance policy any gain on the policy will be subject to federal and possibly state income tax.

The Annual Increase In The Cash Surrender Value Of A Life

The Annual Increase In The Cash Surrender Value Of A Life

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

How To Rescue A Life Insurance Policy With A Loan

How To Rescue A Life Insurance Policy With A Loan

What Is Cash Value Life Insurance Smartasset Com

What Is Cash Value Life Insurance Smartasset Com

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Quiz Worksheet Individual Life Insurance Taxation Study Com

Quiz Worksheet Individual Life Insurance Taxation Study Com

Is Life Insurance Taxable Allstate

Is Life Insurance Taxable Allstate

The Often Overlooked Income Tax Rules Of Life Insurance Policies

The Often Overlooked Income Tax Rules Of Life Insurance Policies

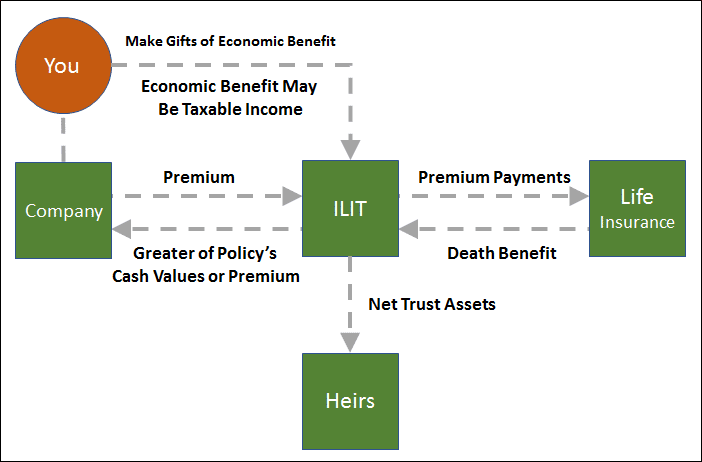

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

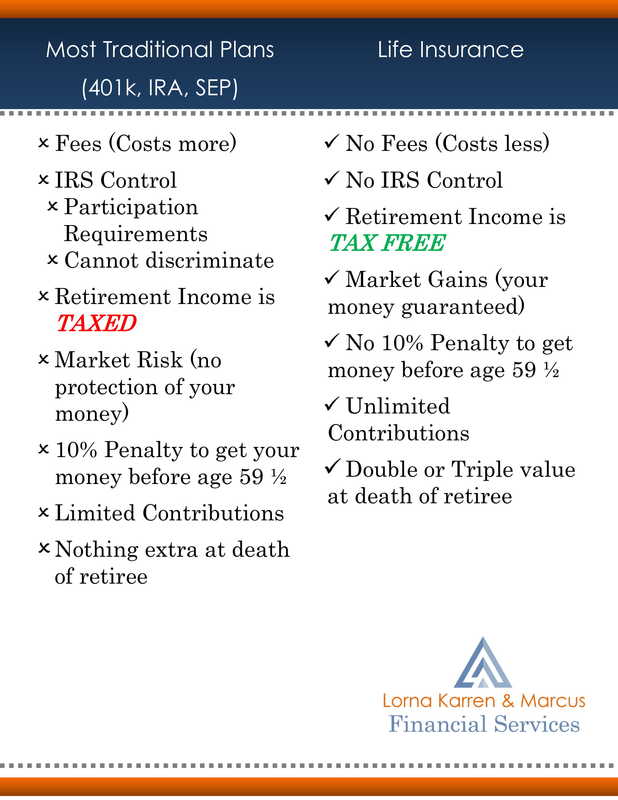

Life Insurance Lorna Karren Marcus Financial Services

Life Insurance Lorna Karren Marcus Financial Services

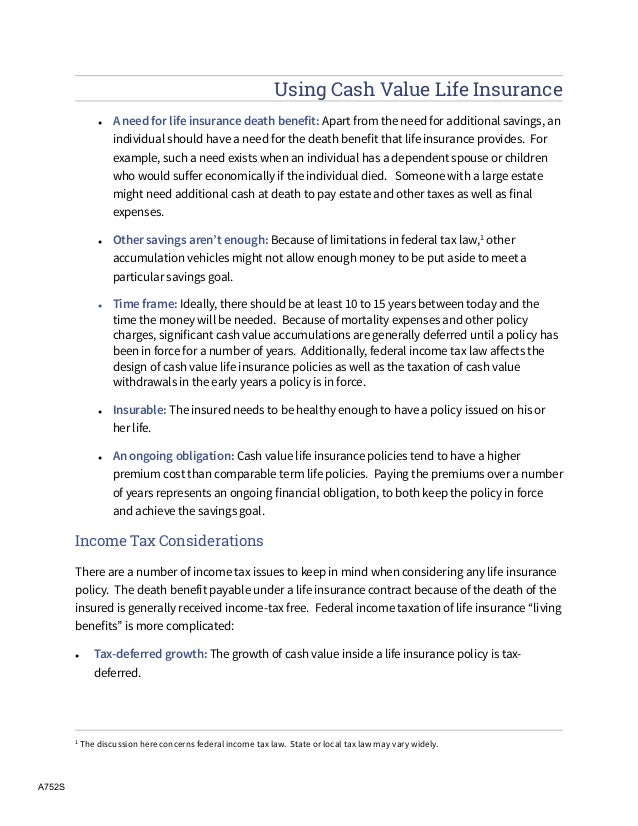

Using Cash Value Life Insurance

Using Cash Value Life Insurance

Using Cash Value Life Insurance

Using Cash Value Life Insurance

Is Life Insurance Taxable Gerber Life Insurance

Is Life Insurance Taxable Gerber Life Insurance

Life Insurance Overview Group Universal Life Metlife

Life Insurance Overview Group Universal Life Metlife

Foreign Life Insurance Taxable Income Fbar Reportable

Foreign Life Insurance Taxable Income Fbar Reportable

A Look At Whole Life Insurance Financial Directions

A Look At Whole Life Insurance Financial Directions

Cashing Out Life Insurance What Are The Advantages And

Cashing Out Life Insurance What Are The Advantages And

Solved 11 The Cash Value In A Whole Life Insurance Polic

Solved 11 The Cash Value In A Whole Life Insurance Polic

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com