In addition to the social security benefits some people choose to purchase life insurance. The life insurance company doesnt always know when the policy owner has died so the beneficiary must alert them by filing a claim.

Whole Life Insurance Definition And Meaning Market Business News

Whole Life Insurance Definition And Meaning Market Business News

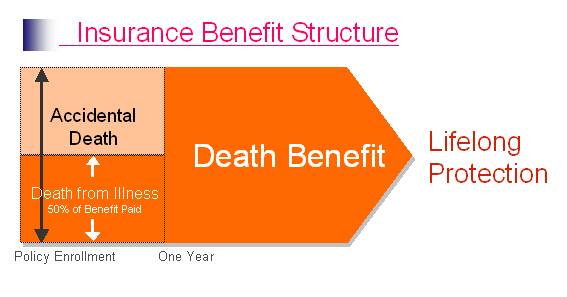

How quickly you receive the death benefit payout is partially influenced by how quickly you file a claim and fill out the right forms.

How long to receive life insurance death benefits. Take these steps to receive the death benefit. When a loved one passes away beneficiaries of the insurance policy can claim a life insurance payout from the insurance provider. Depending on the type of benefits available you may receive payments right away or years down the road.

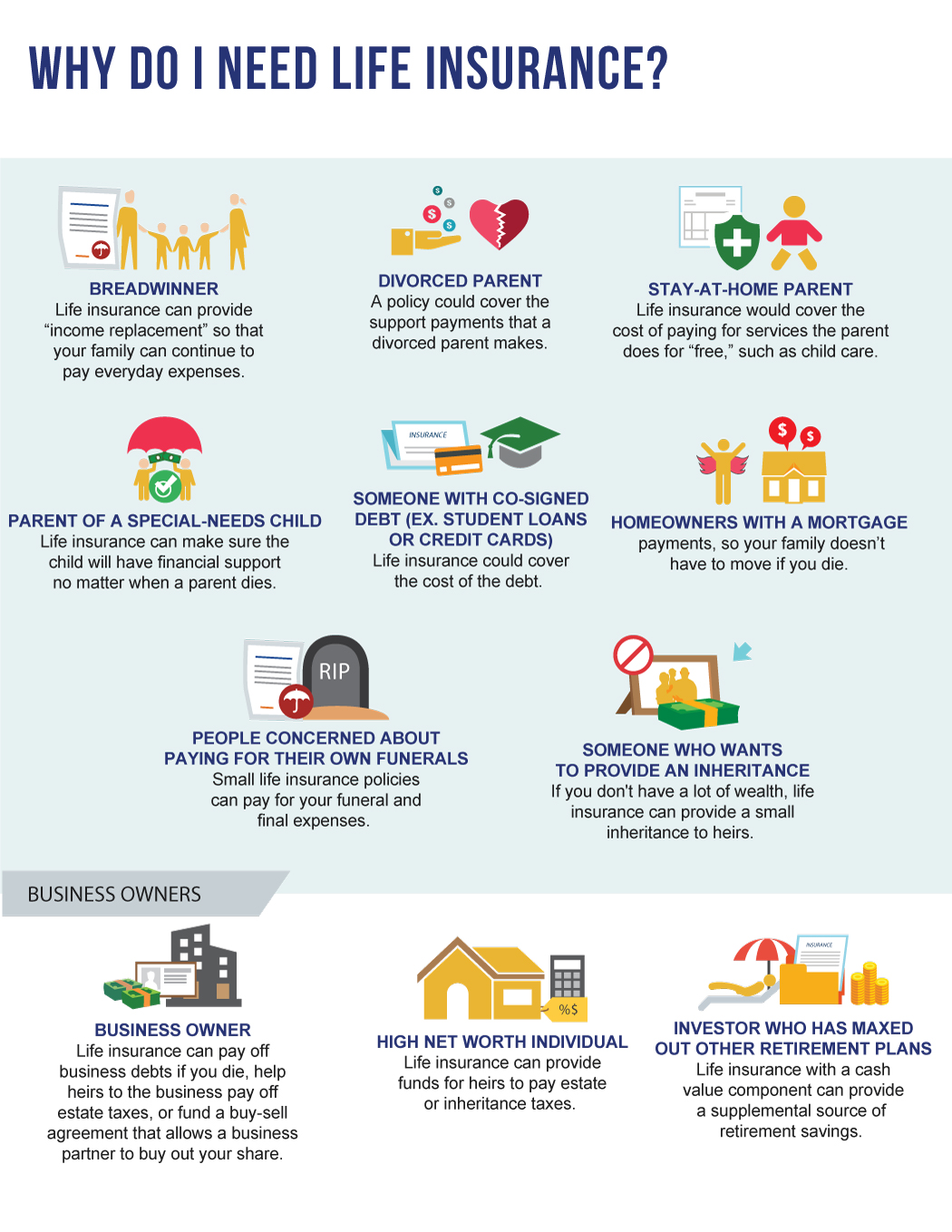

Often this may be the case because the insured was the sole breadwinner for a family or because the bills associated with a persons passing always show up quicker that the benefits. Upon the death of the life insurance owner beneficiaries must inform the event to the insurance company. Either way i can be frustrating when.

How quickly life insurance companies pay out death claims. But if the insured person died long before you make a claim the insurer will generally pay the death benefit plus interest if the life insurance benefit goes into a deceased persons estate and the estate is large enough to be subject to state or federal estate tax the death benefit could be taxed as part of the taxable estate. Many life insurance companies let you file a claim online and they will ask you for a selection of relevant documentation in order to prove the claim.

It can sometimes seem like a lifetime for life insurance companies to actually pay out benefits. Policies and coverage can vary greatly and there is no specified time frame for receiving death benefits. The benefit of a mortgage life insurance is that in the event of the death of the policy holder your family will receive benefits to pay on the mortgage.

When do you receive the death benefit payment. With a life insurance payout the beneficiaries are protected from a sudden loss of financial support. Although the death benefit is paid to the insureds beneficiaries upon death it doesnt always happen automatically.

Life Insurance Death Benefit Tax Free Status Hinerman Group

Life Insurance Death Benefit Tax Free Status Hinerman Group

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

Search Q Life Insurance Memes Tbm Isch

Things You Should Know About Your Whole Life Insurance Benefits

Things You Should Know About Your Whole Life Insurance Benefits

What Is A Life Insurance Beneficiary Betterment

What Is A Life Insurance Beneficiary Betterment

How To Use Money Received As Life Insurance Claim Settlement

How To Use Money Received As Life Insurance Claim Settlement

Accelerated Death Benefit Rider Cashmoneylife Com

Accelerated Death Benefit Rider Cashmoneylife Com

Search Q Universal Life Insurance Tbm Isch

Orix Life Insurance Launches Whole Life Insurance Rise Support

Orix Life Insurance Launches Whole Life Insurance Rise Support

Do You Know What Accelerated Death Benefits Are And Do You Qualify

Do You Know What Accelerated Death Benefits Are And Do You Qualify

Taxes On Life Insurance Death Benefits Other

Taxes On Life Insurance Death Benefits Other

Word Writing Text Life Insurance Business Concept For Payment Of

Word Writing Text Life Insurance Business Concept For Payment Of

Claim Examiners Not All Heroes Wear Capes Haven Life

Claim Examiners Not All Heroes Wear Capes Haven Life

Ensuring Your Path Solutions Protecting Life S Next Steps The

Ensuring Your Path Solutions Protecting Life S Next Steps The

Accelerated Death Benefit In Life Insurance

Accelerated Death Benefit In Life Insurance

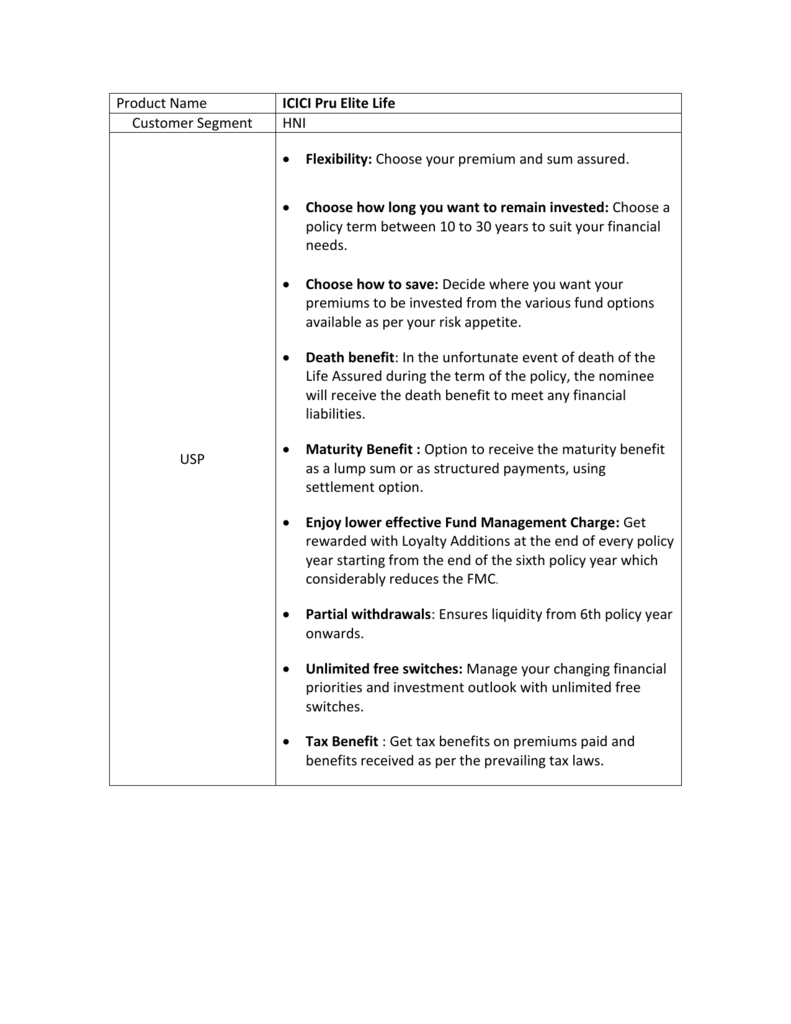

Sales Pitch Icici Prudential Life Insurance

Sales Pitch Icici Prudential Life Insurance

Annual Death Claim Benefit Statistics Beneficiaries Receive More

Annual Death Claim Benefit Statistics Beneficiaries Receive More

When You Stop Paying Whole Life Insurance Premiums

When You Stop Paying Whole Life Insurance Premiums

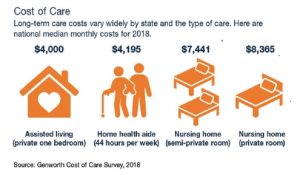

Life Insurance With Long Term Care Benefits Johnston Investment

Life Insurance With Long Term Care Benefits Johnston Investment

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How