Determining coverage amount is a combination of how much coverage you need for example to pay of a certain loan or to pay for a childs upbringing how much you can afford more coverage means higher. When does a term life insurance policy pay out and how long does it usually take.

Insure Canadian Term Life Insurance

Insure Canadian Term Life Insurance

When youre buying term life insurance you have two main decisions.

How long is term life insurance. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Can the term insurance. I f youre shopping for term life insurance two important considerations are how much coverage you need.

I just read a recent article about life insurance in your 20s and i would have a couple of questionshow long can term insurance terms be. So the question that remains once youve gotten this far is how many years of term life insurance do i need. To effectively incorporate a term life insurance policy into your financial portfolio you must understand how and when term life insurance payouts are delivered to beneficiaries.

Term life policies have no value other than the guaranteed death benefit. The duration of the financial obligations you. And how long your term should be.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Because of its low cost compared to other types of life insurance term life is a popular life insurance choice. Term life insurance is a popular part of long term financial planning.

Once youve decided that you want term life insurance instead of whole life you have two more decisions to make. While many people folks on the amount of coverage. How much coverage you need and how long you want your term to last.

How much coverage to buy and how long the policy should last. How long is term life insurance if you are looking for quotes on different types of insurance then our service can help you find what you are looking for. If you have the right term life insurance policy your spouse will receive enough money from the policys death benefit to pay off or at least keep up with the mortgage.

There is no savings component as found in a whole life insurance product. As you might have guessed the answer isnt immediately obvious but by taking a look at a few different aspects of your life you should be able to find the right answer. The policys purpose is to give insurance to.

Does Term Life Insurance Expire Haven Life

Does Term Life Insurance Expire Haven Life

How Does Basic Group Term Life Insurance Work Glg America

How Does Basic Group Term Life Insurance Work Glg America

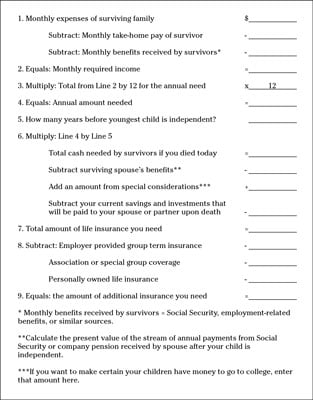

How Much Life Insurance Do You Need Dummies

How Much Life Insurance Do You Need Dummies

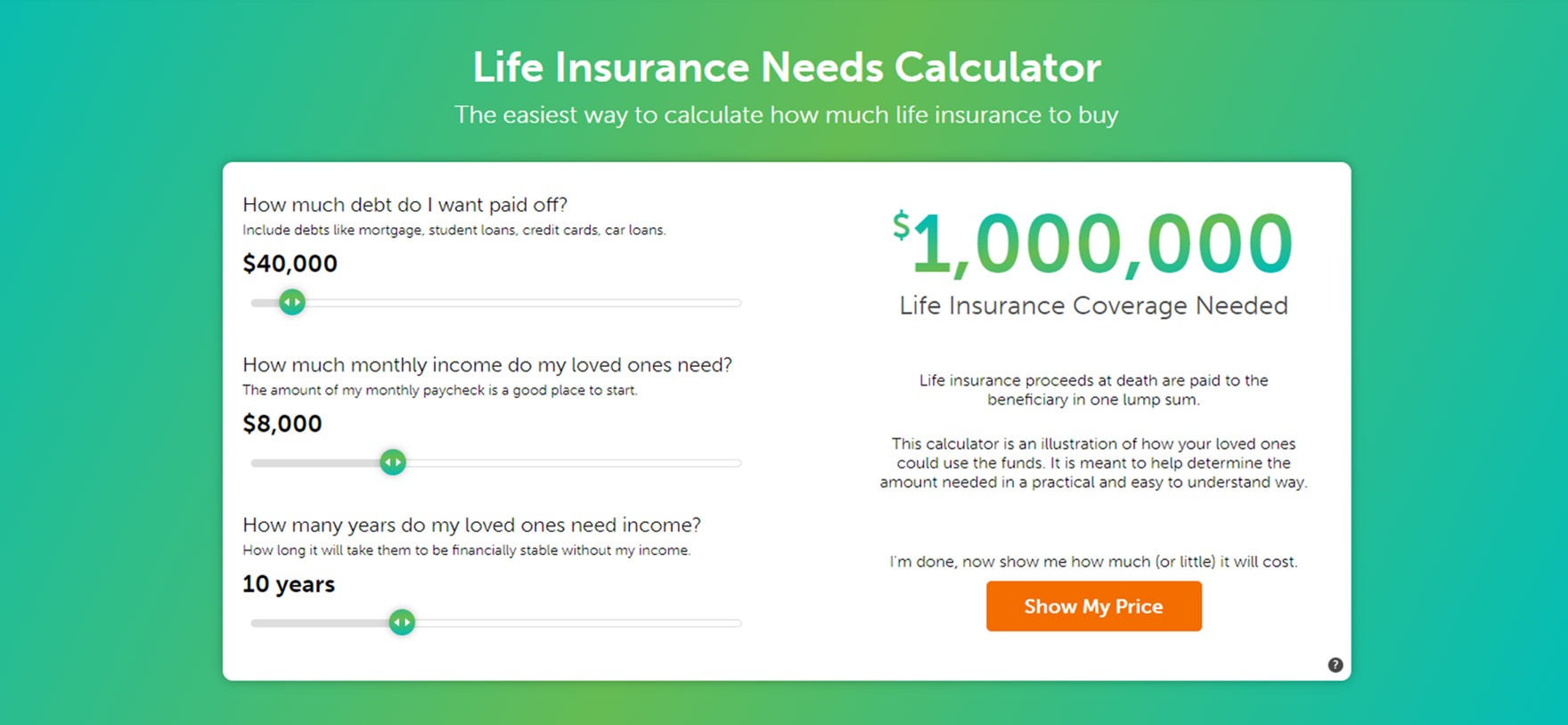

Buy Term Life Insurance Online In 2020 Instant Coverage

Buy Term Life Insurance Online In 2020 Instant Coverage

What Is Decreasing Term Life Insurance Quotacy

What Is Decreasing Term Life Insurance Quotacy

How Long Should Your Term Life Insurance Last

How Long Should Your Term Life Insurance Last

Hybrid Insurance Policies Blend Long Term Care Life Coverage

Hybrid Insurance Policies Blend Long Term Care Life Coverage

Life Insurance Coverage Group Term Life Plan In Wisconsin

Life Insurance Coverage Group Term Life Plan In Wisconsin

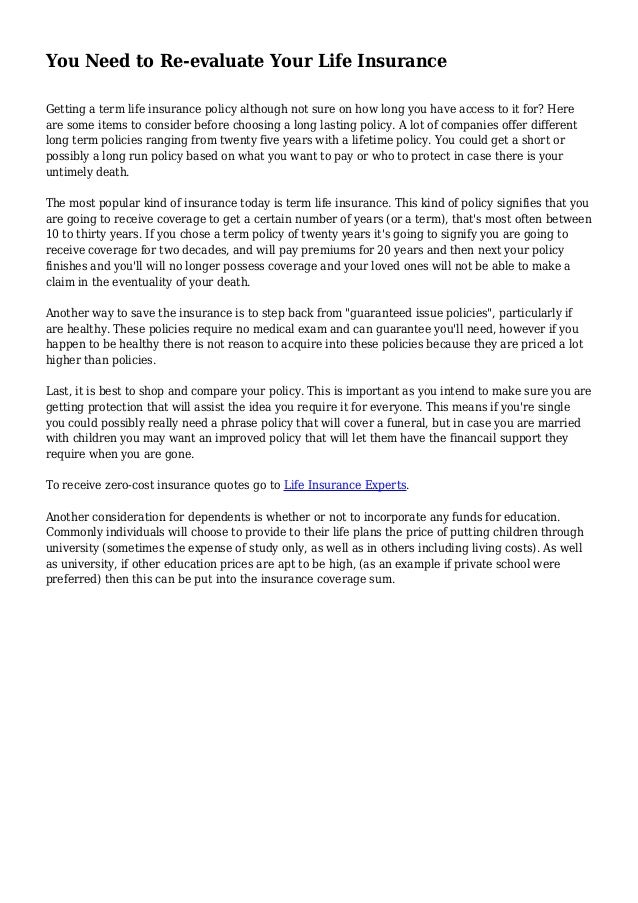

You Need To Re Evaluate Your Life Insurance

You Need To Re Evaluate Your Life Insurance

The Best 20 Year Term Life Insurance 2019 Pros And Cons Riskquoter

The Best 20 Year Term Life Insurance 2019 Pros And Cons Riskquoter

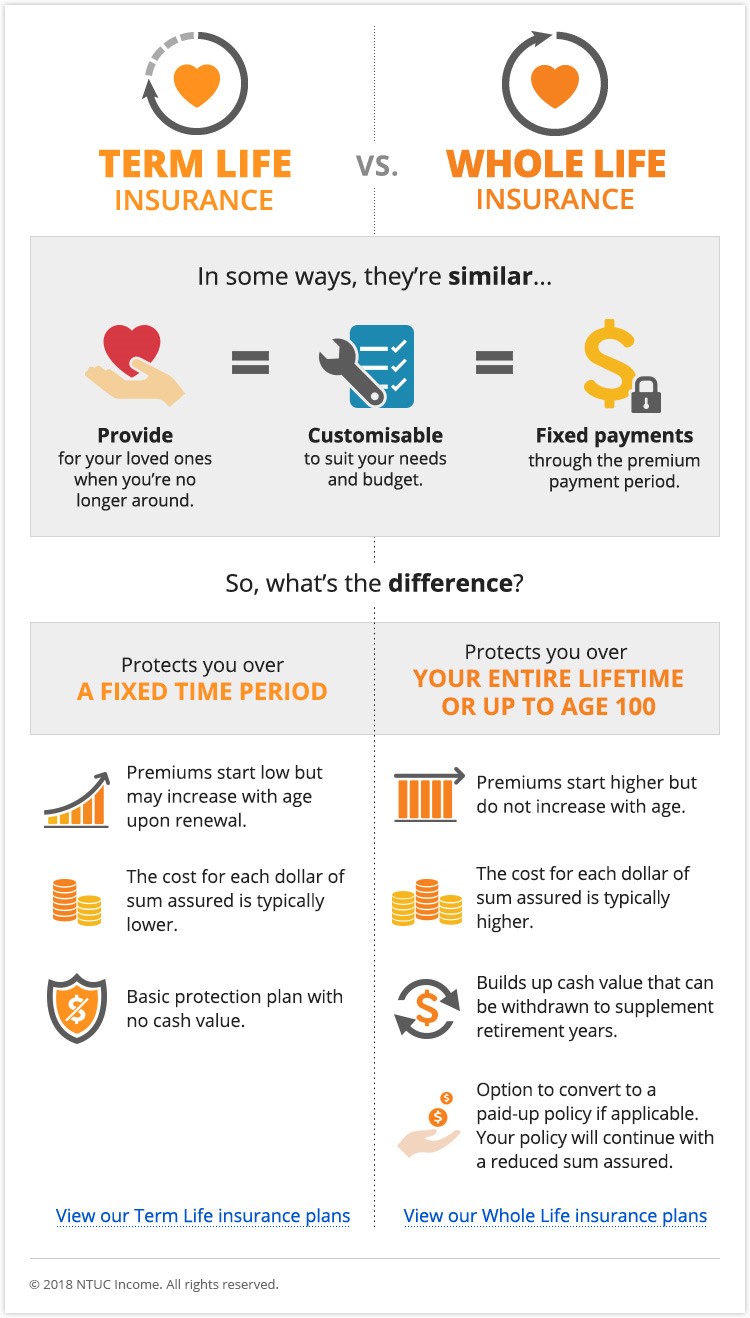

The Right Protection Plan Ntuc Income

The Right Protection Plan Ntuc Income

How To Select The Best Term Life Insurance Plan For You

How To Select The Best Term Life Insurance Plan For You

How To Benefit From Term Life Insurance Lowestrates Ca

How To Benefit From Term Life Insurance Lowestrates Ca

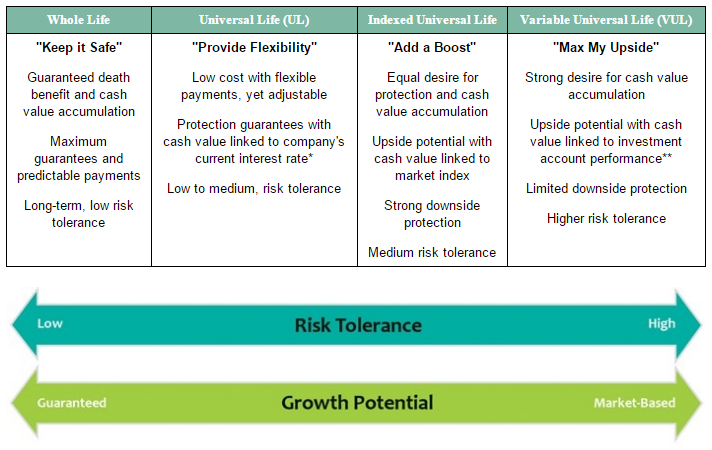

Life Insurance Basics How To Choose The Right Policy Penn Mutual

Life Insurance Basics How To Choose The Right Policy Penn Mutual

How Does Term Life Insurance Work Difinitive Guide 2020

How Does Term Life Insurance Work Difinitive Guide 2020

Life Insurance Types Flow Chart Typesofinsurance Insurance

Life Insurance Types Flow Chart Typesofinsurance Insurance

How Long Your Term Life Insurance Should Last Nerdwallet

How Long Your Term Life Insurance Should Last Nerdwallet

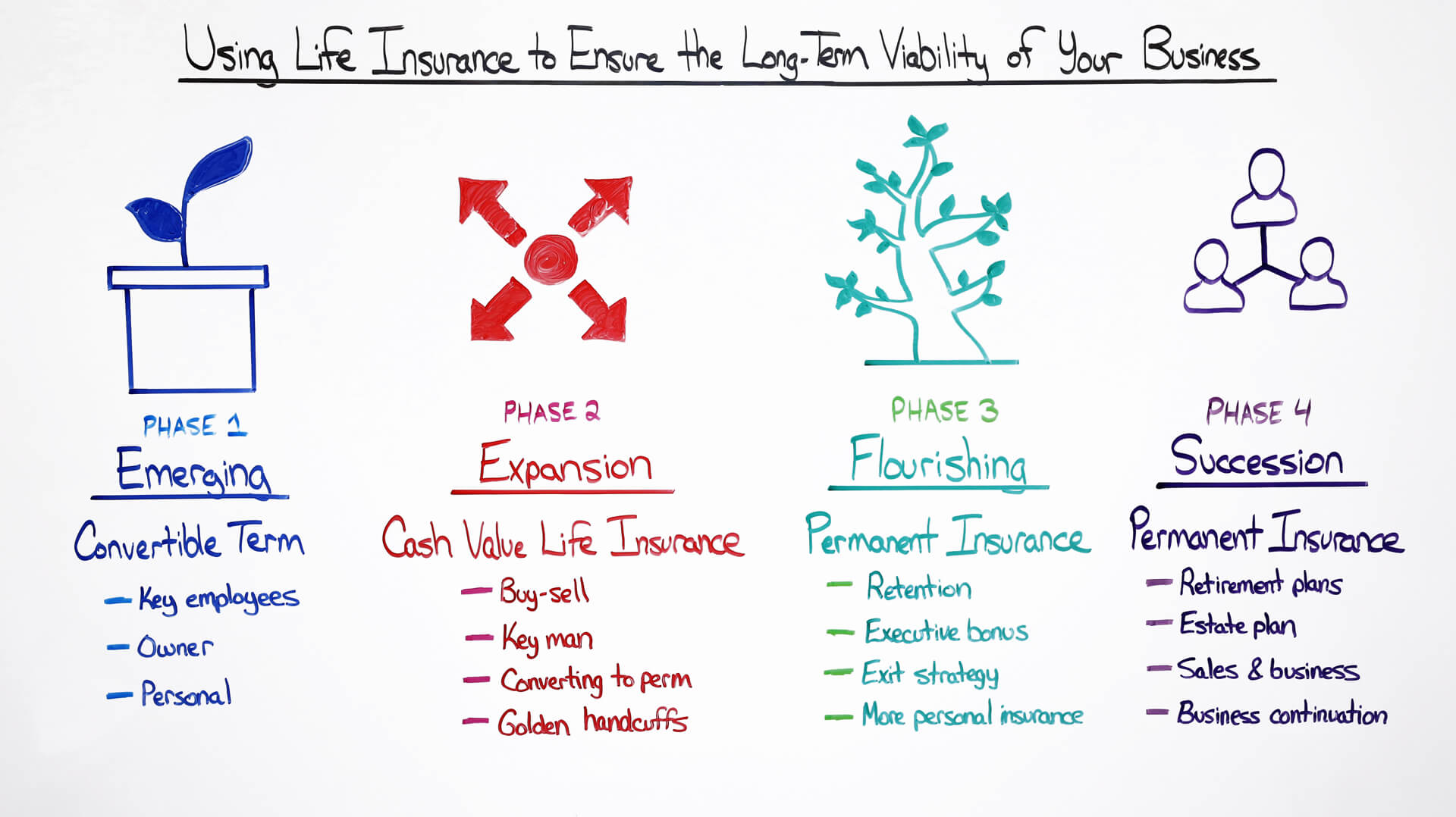

Episode 53 Using Life Insurance To Ensure The Long Term Viabili

Episode 53 Using Life Insurance To Ensure The Long Term Viabili

How To Use A Life Insurance Policy To Pay For Long Term Care

How To Use A Life Insurance Policy To Pay For Long Term Care

How To Sell Insurance As An Independent Agent Infographic Life

How To Sell Insurance As An Independent Agent Infographic Life

:max_bytes(150000):strip_icc()/GettyImages-1083840976-a828869589624ed28316b9352c7aff11.jpg)