Beneficiaries who are given a lump sum dont have to pay any kind of income tax on the policy. Generally life insurance payouts after the death of someone are not going to be taxed.

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

When you receive a death benefit under either policy its almost always considered non taxable and doesnt need to be reported on your tax return.

/canada-revenue-agency--l-tower-condos-and-sony-centre-for-the-performing-arts--toronto--ontario--canada-528403178-5b7c46d3c9e77c005085a66b.jpg)

Is life insurance taxable in canada. Employers guide taxable benefits and allowances. Life insurance plays an increasingly important role in financial planning due to the growing wealth of canadians. Its one of those purchases that no one wants to talk about but everyone needs it.

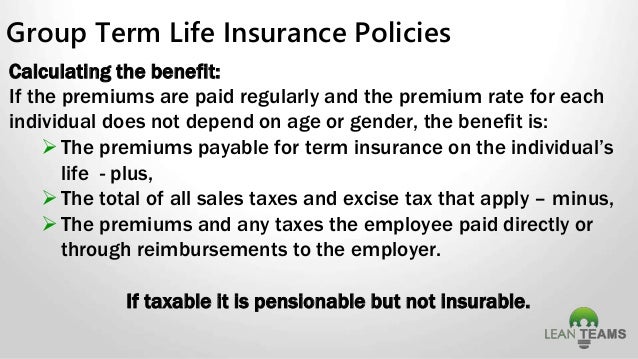

If youre like most canadians your employer probably provides you with a basic group life insurance policy. For premiums under a hospital or medical care insurance plan for its employees and their dependants serving outside canada is a taxable. Term life insurance options for couples.

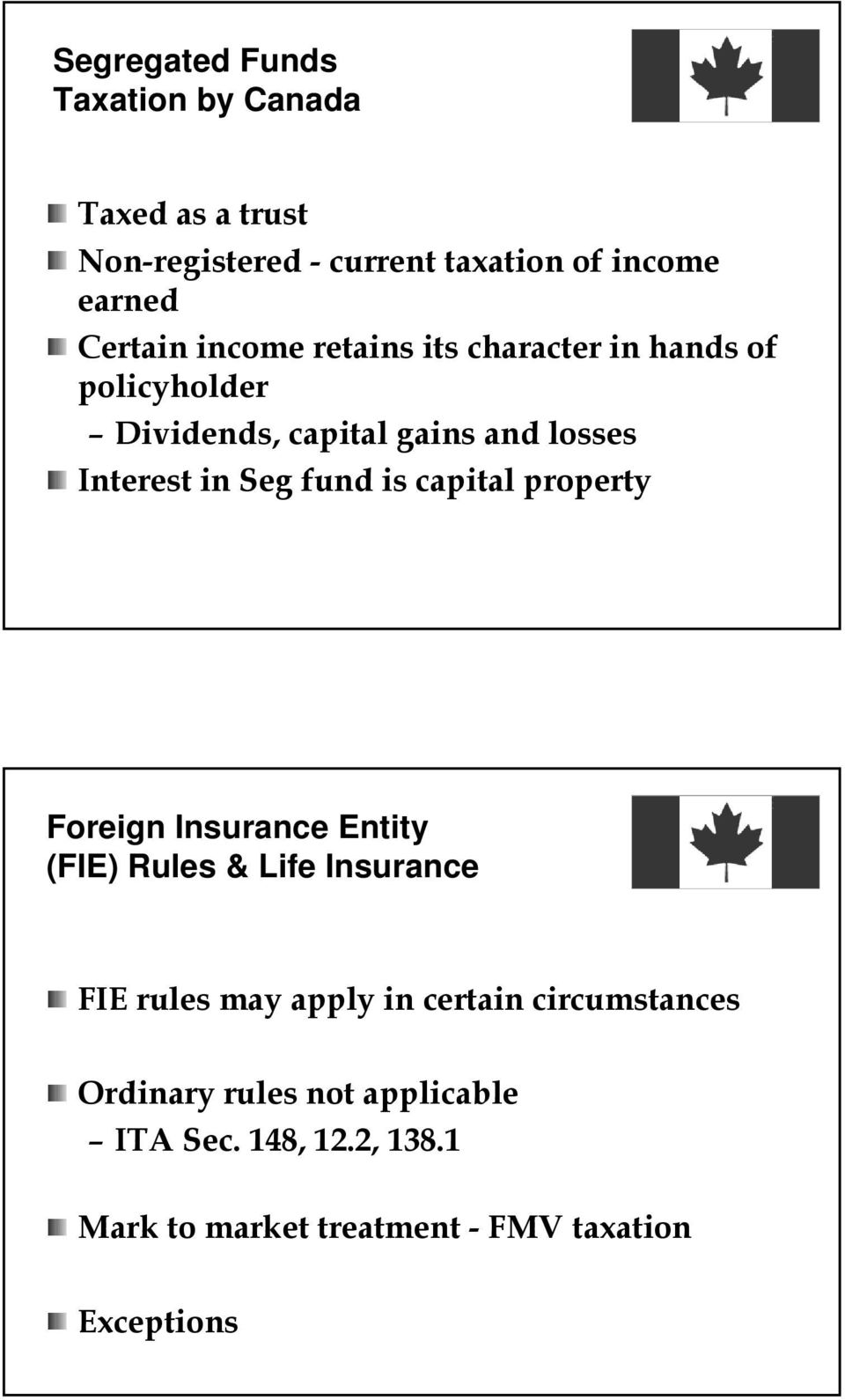

This is a question i get all the time. Thats why the tax implications are such an important part of life insurance planning. From a tax perspective life insurance is neither capital property nor debt instrument.

Life insurance can help with end of life expenses such as your funeral and it can help relieve certain tax liabilities for your survivors. Note income earned on any of the above amounts such as interest you earn when you invest lottery winnings is taxable. Life insurance distributions following death life insurance distributions following the death of someone else are not taxed.

Besides the traditional role of protecting families when a parent dies prematurely many affluent individuals use life insurance to protect their wealth against taxes. Most types of strike pay you received from your union even if you perform picketing duties as a requirement of membership. Overview of canadian taxation of life insurance policies.

However before purchasing life insurance you should understand how the canada revenue agency taxes its distributions. People buy life insurance so that if the unimaginable happens theyll be financially protected. Life insurance taxes in canada if someone gets life insurance will they be leaving a lump sum and taxes to their loved ones.

Premiums you pay for employees group life insurance that is not group term insurance or optional dependent life insurance are also a taxable. Is life insurance taxable in canada. Im sure youre asking as to whether or not the life insurance death benefit is taxable in canada.

First life insurance premiums whether paid personally or by a corporation are typically non deductible resulting in premiums being funded with after tax dollars. Most amounts received from a life insurance policy following someones death. Your life insurance premiums on the other hand are taxed at the time of contribution wherein all insurance premiums are charged their corresponding sales taxes.

In this case life insurance death benefits are not taxable in canada. Its governed by a special set of rules in the income tax act and accompanying regulations. Term life insurance premiums are generally less expensive than permanent life insurance premiums when you first buy the policy.

There are two main types of life insurance policies. When considering buying life insurance as a couple look at what coverage you may already have through your employer or that you may have bought when you were on your own.

Is A Life Insurance Payout Taxable Rbc Insurance

Is A Life Insurance Payout Taxable Rbc Insurance

Tax Evasion There Are Consequences Canada Ca

Tax Evasion There Are Consequences Canada Ca

/payrollfiles-57a621f05f9b58974a262cf8.jpg) How To Do Payroll Deductions In Canada

How To Do Payroll Deductions In Canada

Tfsa Limit For 2019 Released Advisor

Tfsa Limit For 2019 Released Advisor

Exercise Caution In Relying On Cra Policy Kalfa Law

Exercise Caution In Relying On Cra Policy Kalfa Law

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

126 Best Life Insurance Keywords For Marketing Free Download

126 Best Life Insurance Keywords For Marketing Free Download

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Is Life Insurance Taxable In Canada Youtube

Is Life Insurance Taxable In Canada Youtube

Life Disability And Income Insurance Hudson S Bay Financial

Life Disability And Income Insurance Hudson S Bay Financial

Pdf Meaning Of Permanent Establishment In Article 5 Of Double

Pdf Meaning Of Permanent Establishment In Article 5 Of Double

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Buy Sell Agreements Corporate Owned Life Insurance Pdf Free Download

Buy Sell Agreements Corporate Owned Life Insurance Pdf Free Download

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

Opportunities And Pitfalls For Foreign Inheritances And

Opportunities And Pitfalls For Foreign Inheritances And

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

Benefits Drawbacks Of Life Insurance By Marta Galavis Issuu

Benefits Drawbacks Of Life Insurance By Marta Galavis Issuu

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcr76tgu11arog Fha2eurizderuxv906eoehy9fleuwvfsp9x0g

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcr76tgu11arog Fha2eurizderuxv906eoehy9fleuwvfsp9x0g

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

Life 2008 Spring Meeting June 16 18 Session 93 Insurance

Group Life Insurance Group Life Insurance Taxable Benefit Canada

Group Life Insurance Group Life Insurance Taxable Benefit Canada

Employee Benefits Taxable Or Not Sun Life

Employee Benefits Taxable Or Not Sun Life

/canada-revenue-agency--l-tower-condos-and-sony-centre-for-the-performing-arts--toronto--ontario--canada-528403178-5b7c46d3c9e77c005085a66b.jpg) Taxable Benefits For Employers In Canada

Taxable Benefits For Employers In Canada

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks