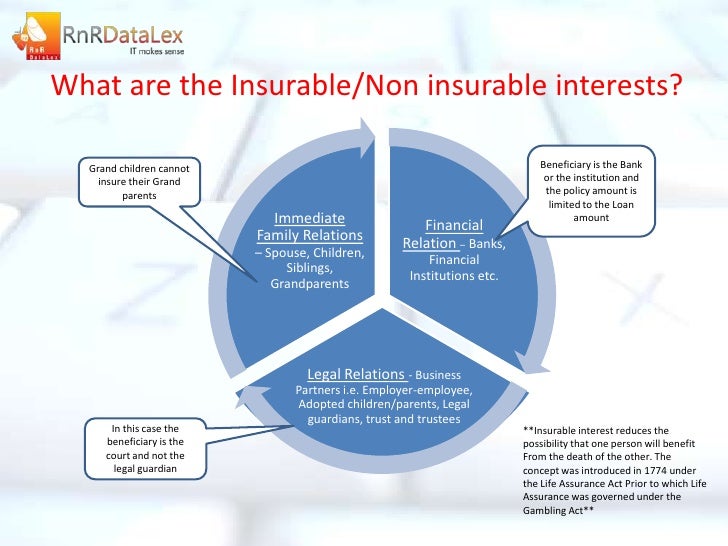

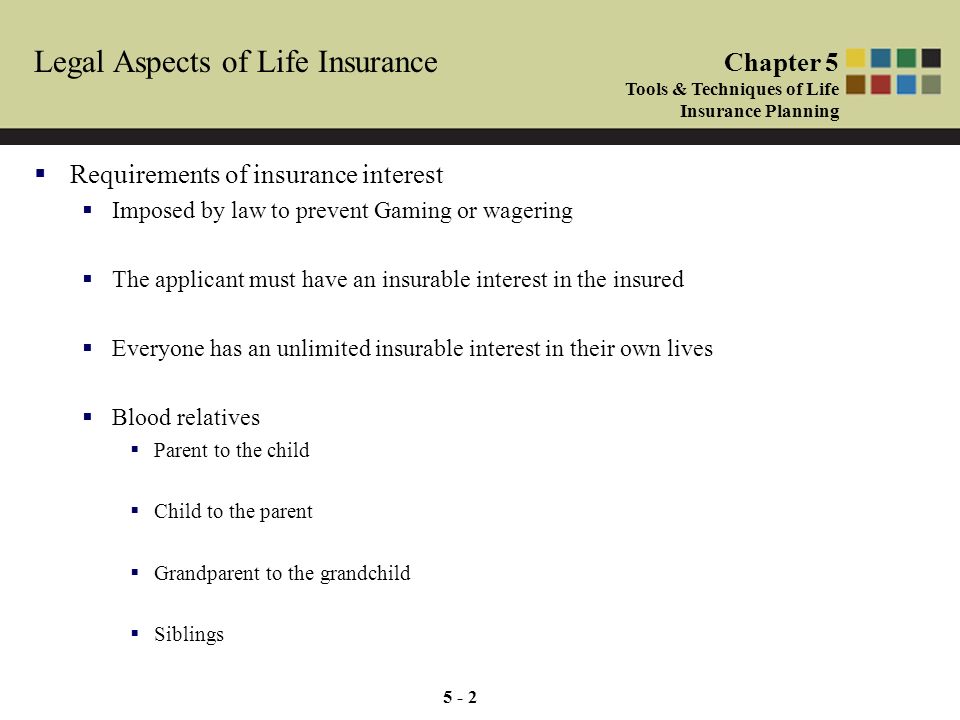

Life insurance plans are one of the most protected pieces of property a person can own. In life insurance a person would have an insurable interest if the death of the insured would result in a financial or otherwise significant loss.

The principle of insurable interest on life insurance is that a person or organization can obtain an insurance policy on the life of another person if the person or organization obtaining the insurance values the life of the.

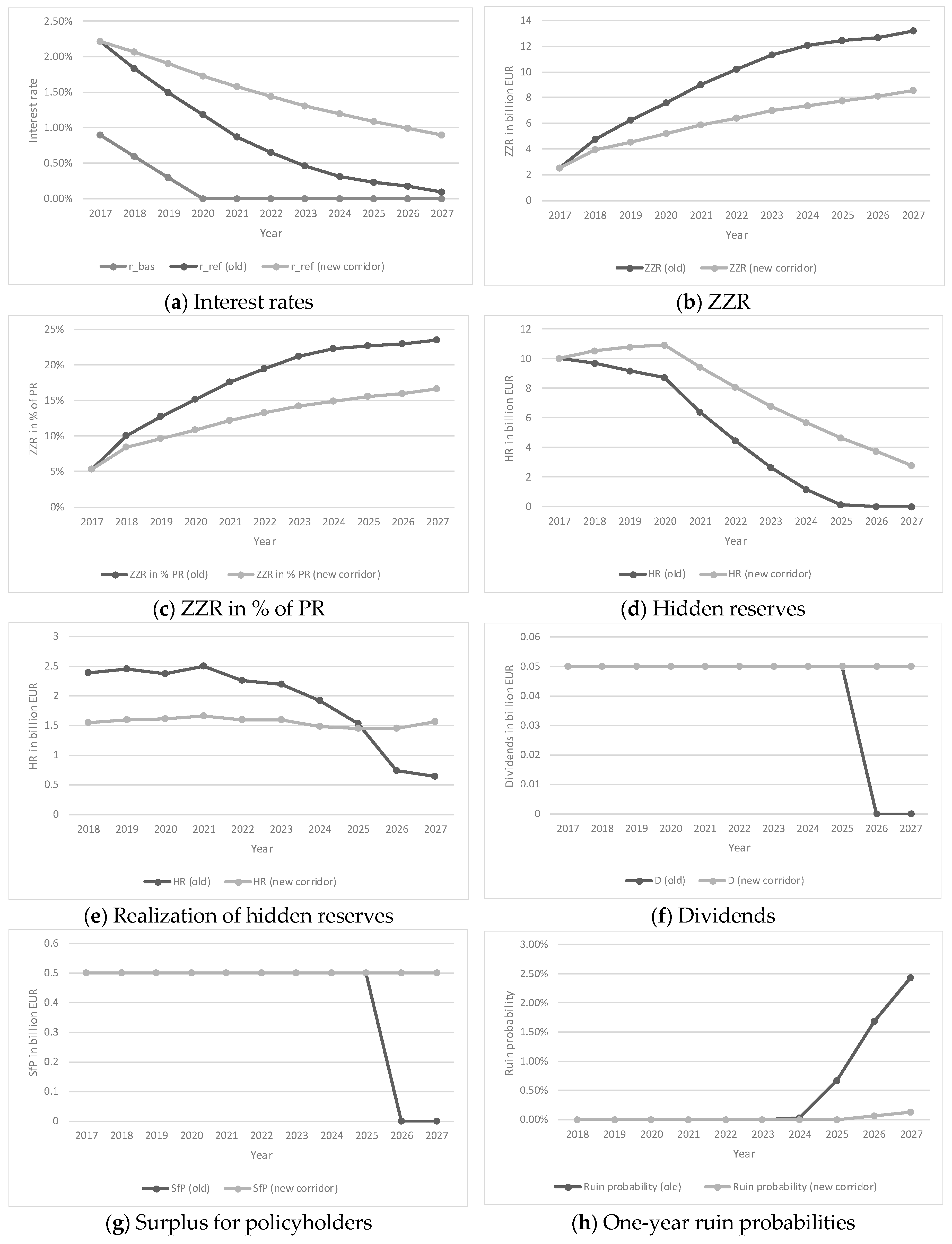

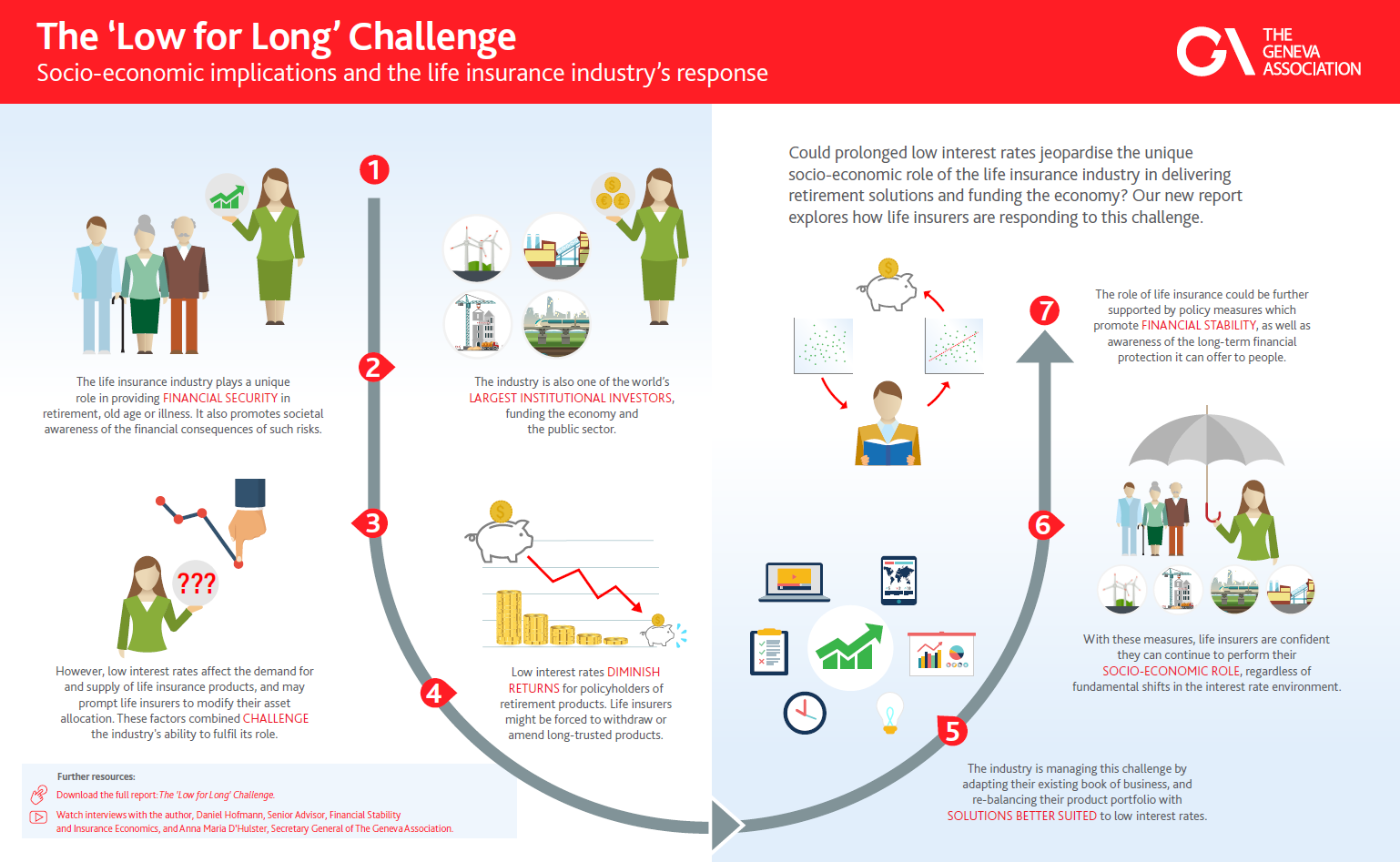

Interest on life insurance. Drivers of guaranteed life insurance product pricing for pricing to decrease life insurance companies need to believe that long term interest rates will rise and remain higher than they are today. The conceptual framework introduced above suggests that to understand a companys exposure to interest rate risk ie how changes in interest rates affect its equity value. Effects of interest rate risk on life insurance company valuations.

Insurable interest is a requirement for all life insurance policy owners which makes it crucial to identify. Is accrued interest on a life insurance payout subject to federal income tax. Insurable interest is no longer strictly an element of life insurance contracts under modern law.

Life insurance contract is not a contract of indemnity and a person affecting a policy must have an insurable interest in the life to be assured. Accordingly a person may purchase a life insurance policy on his own life making the proceeds payable to anyone he wishes. Insurance companies may offer a number of ways.

Prior to applying for life insurance coverage it is important to understand who or what may have an insurable interest in the individual who is being insured as this could have a bearing on the acceptability of the beneficiary or beneficiaries that are chosen. Germany is the third largest life insurance market in europe with a total gross premium income for individual life insurance of about eur 70 billion in the year 2014. One of the protections is that gains via interest and dividends if in a participating usually mutual company plan are not taxable as long as they are in the policy.

Exceptions include viatication agreements and charitable donations. This means when a beneficiary receives life insurance proceeds after a period of interest accumulation rather than immediately upon the policyholders death he must pay taxes not on the entire. 5 traditionally life insurance companies in germany focused on selling profit participating endowment products with a conservative interest rate assumption.

Life insurance proceeds typically pay out tax free to the beneficiary.

How To Open Savings Account And Get Free Life Insurance In Bdo And

How To Open Savings Account And Get Free Life Insurance In Bdo And

What Is Cash Value Life Insurance In 2019 Reviews Om

What Is Cash Value Life Insurance In 2019 Reviews Om

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

Jrfm Free Full Text Dealing With Low Interest Rates In Life

Jrfm Free Full Text Dealing With Low Interest Rates In Life

The Low For Long Challenge Socio Economic Implications And The

The Low For Long Challenge Socio Economic Implications And The

Katilim Emeklilik Interest Free Life Insurance Options

Katilim Emeklilik Interest Free Life Insurance Options

Life Insurance Is A Liquid Investment The Bright Spot

Life Insurance Is A Liquid Investment The Bright Spot

Lic Jeevan Shanti Interest Credited Monthly To Your Policy

Lic Jeevan Shanti Interest Credited Monthly To Your Policy

Guard Your Loved Ones Using A Life Insurance Coverage Insurance Policy

Guard Your Loved Ones Using A Life Insurance Coverage Insurance Policy

Impact Of Interest Rates On Life Insurance Products Wealth

Impact Of Interest Rates On Life Insurance Products Wealth

Pdf How Do The Infation Rate And The Interest Rate Affect The Non

Pdf How Do The Infation Rate And The Interest Rate Affect The Non

Repercussions Of A Sustained Low Interest Rate Environment On Life

Repercussions Of A Sustained Low Interest Rate Environment On Life

The Doctrine Of Insurable Interest Essay Example Topics And Well

The Doctrine Of Insurable Interest Essay Example Topics And Well

Whole Life Insurance How It Works

Whole Life Insurance How It Works

Low Cost Life Insurance Insurable Interest Life Insurance Beneficiary

Low Cost Life Insurance Insurable Interest Life Insurance Beneficiary

New York Issues Final Best Interest Regulation For Annuity Life

New York Issues Final Best Interest Regulation For Annuity Life

5 1 Legal Aspects Of Life Insurance Introduction Life

5 1 Legal Aspects Of Life Insurance Introduction Life

Valuation Of Life Insurers 2015 Expert Commentary Irmi Com

Valuation Of Life Insurers 2015 Expert Commentary Irmi Com

Pru Life Uk Investment Packages The Foodie Geek

Pru Life Uk Investment Packages The Foodie Geek

How Do Universal Life Insurance Policies Work Finance Zacks

How Do Universal Life Insurance Policies Work Finance Zacks