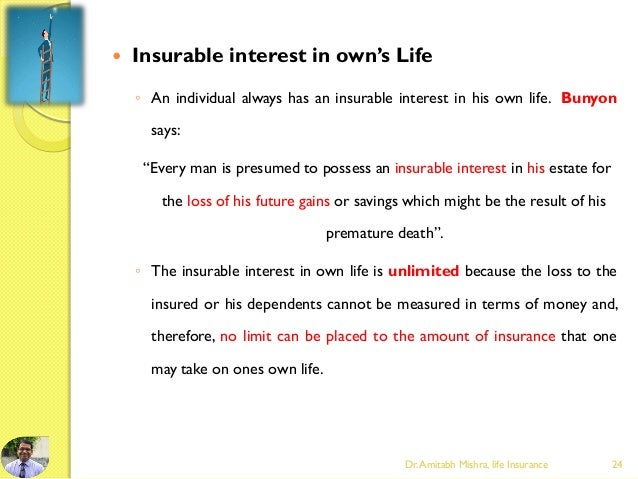

What is an insurable interest in life insurance. In life insurance a person has an insurable interest in another person when the death of that person would cause a financial emotional or another type of loss.

You buy life insurance so that the people who depend on you the most wont struggle financially in the event you were to unexpectedly die.

Insurable interest in life insurance. In the case of life insurance it refers to the potential needs the beneficiary will require from the financial loss of the insured person. Insurable interest is simply defined as the level of hardship financial dependency and otherwise a person will suffer from the loss of something or someone they have insured. What you need to know about insurable interest.

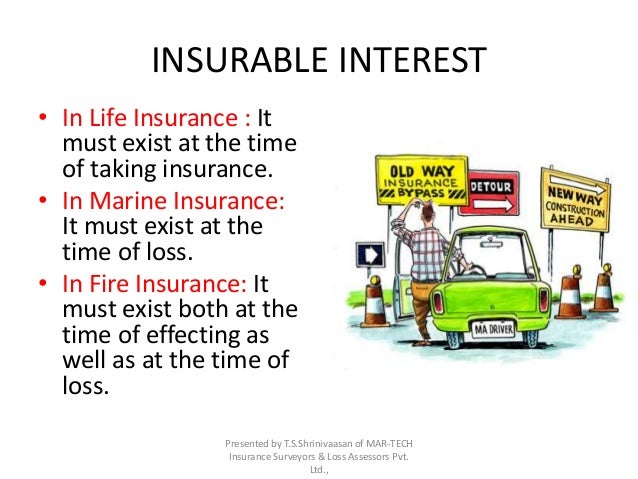

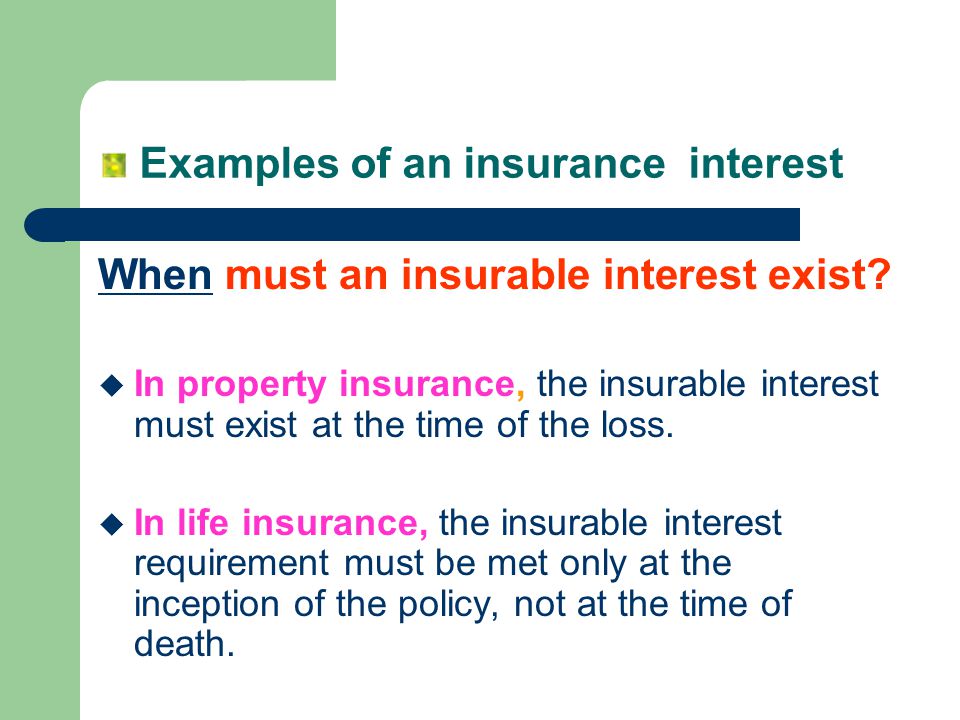

Prior to applying for life insurance coverage it is important to understand who or what may have an insurable interest in the individual who is being insured as this could have a bearing on the acceptability of the beneficiary or beneficiaries that are chosen. Its important to mention that insurable interest must only exist at the time of the application. Insurable interest in life insurance if you are looking for low cost comprehensive insurance then we can provide you with multiple quotes to help you find a provider you are happy with.

For example someone with malicious intent could sign you up for life insurance. They could do this without your knowledge and consent. Proof of insurable interest along with consent from the insured is required to purchase a life insurance policy on another person.

It also prevents the person the insurance belongs to from harm. You can only have an insurable interest if you personally lose in the event of someone passing away. What is insurable interest.

If there is no insurable interest the life insurance policy is void. An insurable interest exists when a beneficiary essentially derives a financial or other type of benefit from the continuous existence of the insured person so then if the insured person were to die the beneficiary would suffer some type of financial loss. An insurable interest in life insurance is not only used to combat fraud.

That being said one of the key elements of a life insurance policy is your beneficiary the person or entity named on your policy to receive the proceeds when you die. To stop your good neighbor sam from taking out a life insurance policy on you and then killing you to get the life insurance money your neighbor as the purchaser of the insurance policy must have an insurable interest in the life of you the person being insured at the time of application. Insurable interest in life insurance if you are looking for a convenient way to get quotes on different types of insurance then look no further than our insurance quotes service.

What Is An Insurable Interest In Life Insurance Definition Faqs

What Is An Insurable Interest In Life Insurance Definition Faqs

Introduction To Life Insurance I By Dr Amitabh Mishra

Introduction To Life Insurance I By Dr Amitabh Mishra

The Doctrine Of Insurable Interest Essay Example Topics And Well

The Doctrine Of Insurable Interest Essay Example Topics And Well

Examples Of Insurable Interest In Different Insurances

Examples Of Insurable Interest In Different Insurances

Insurance Contract Law Post Contract Duties And Other Issues

Insurance Contract Law Post Contract Duties And Other Issues

What Are The Six Principles Of Insurance Finance Zacks

What Are The Six Principles Of Insurance Finance Zacks

Life And Health Insurance Agent Licensing Practice Exam 2020 Current

Life And Health Insurance Agent Licensing Practice Exam 2020 Current

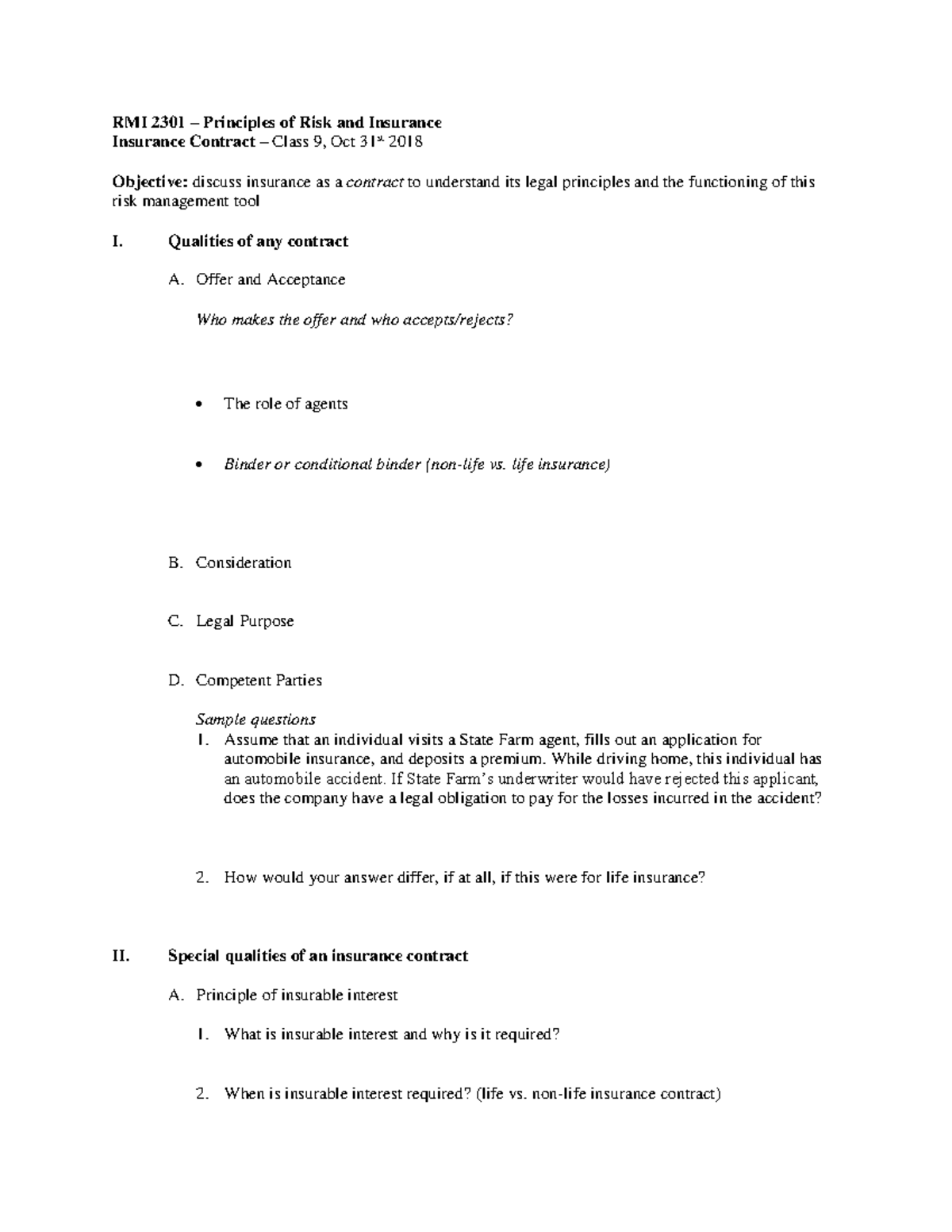

Class 9 Outline Insurance Contract Rmi 2301 St John S Studocu

Class 9 Outline Insurance Contract Rmi 2301 St John S Studocu

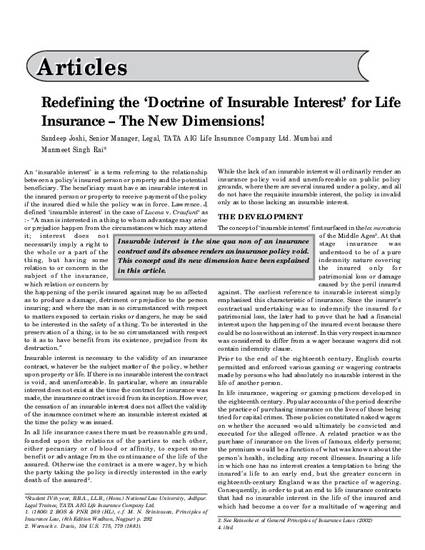

Redefining The Doctrine Of Insurable Interest For Life Insurance

Redefining The Doctrine Of Insurable Interest For Life Insurance

Maryland Insurance B Insurable Interest 2 I For

Maryland Insurance B Insurable Interest 2 I For

Insurable Interest And Life Insurance Insurance And Reinsurance

Insurable Interest And Life Insurance Insurance And Reinsurance

The Definition Of Insurable Interest A Right Or Relationship In

The Definition Of Insurable Interest A Right Or Relationship In

What Does Insurable Interest Mean In Life Insurance

What Does Insurable Interest Mean In Life Insurance

Chapter 49 Insurance Insurance Insurance Is A Contractual

Chapter 49 Insurance Insurance Insurance Is A Contractual

Summary Of State Insurable Interest Regulations Current As Of 12 8

Summary Of State Insurable Interest Regulations Current As Of 12 8

Insurable Interest Definition Types Example Explained

Insurable Interest Definition Types Example Explained

Quiz Worksheet Insurable Interest Definition Study Com

Quiz Worksheet Insurable Interest Definition Study Com

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

/GettyImages-97218582-5988be0e0d327a001142ffdf.jpg) What Does Insurable Interest Mean

What Does Insurable Interest Mean

Ppt Legal Principles Of Insurance Contracts Powerpoint

Ppt Legal Principles Of Insurance Contracts Powerpoint

Fundamental Principles In Insurance Ppt Video Online Download

Fundamental Principles In Insurance Ppt Video Online Download

Insurance Notes Insurance Parties And Insurable Interest

Insurance Notes Insurance Parties And Insurable Interest