Legal and general adviser support for our increasing life insurance including cover overview benefits options. Increasing term life insurance.

Business Law Essential Standard 4 00 Objective Understand Types

Business Law Essential Standard 4 00 Objective Understand Types

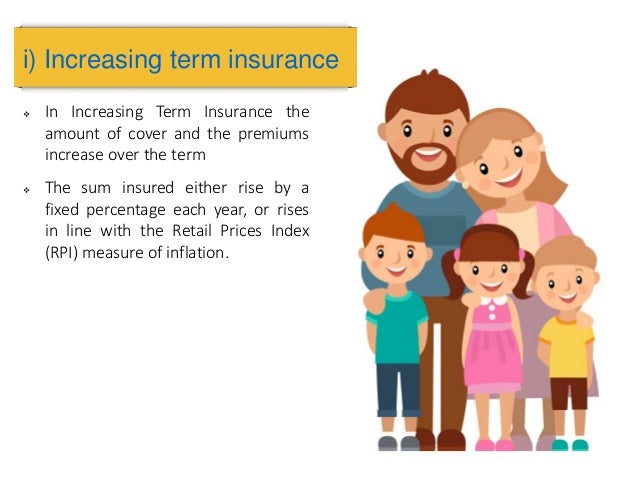

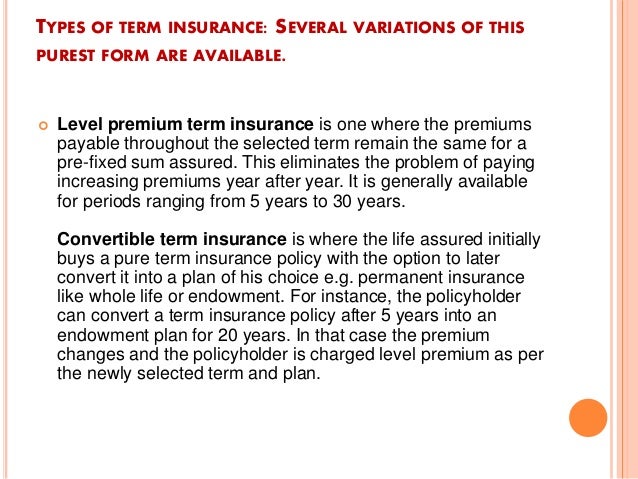

Like some of the other policies that we have examined increasing term life insurance can either be added as a rider or can be part of the policy itself.

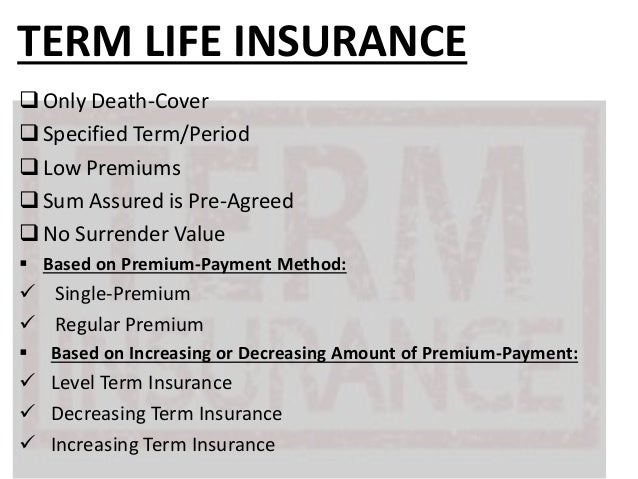

Increasing term life insurance. Increasing term life insurance if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options. Decreasing term life insurance sometimes known as mortgage decreasing term insurance is bought by homeowners who want to make sure their mortgage will be settled after their death. Life insurance learning center term life insurance types.

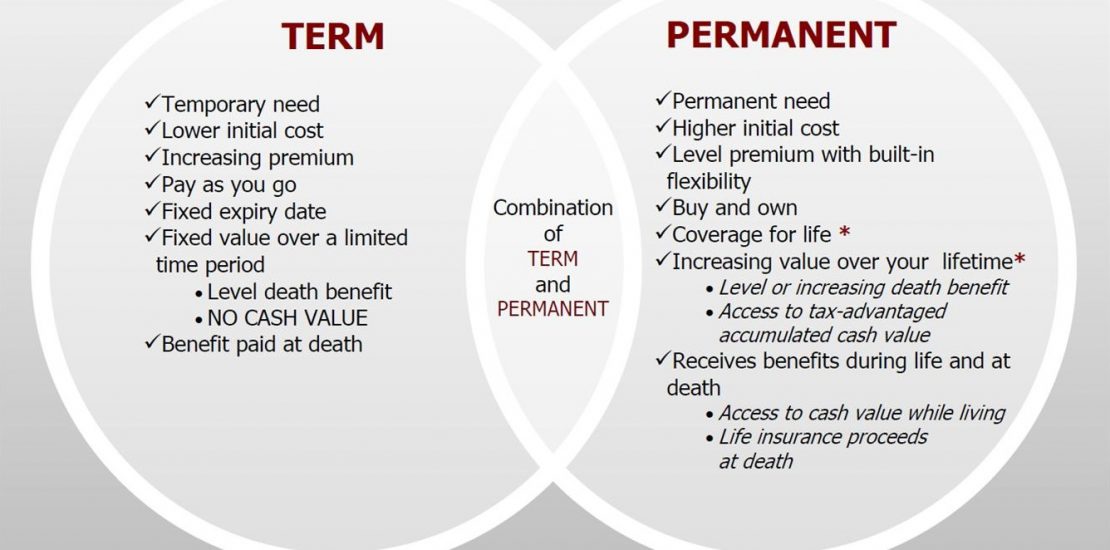

Life insurance is not a savings or investment product and has no cash value unless a valid claim is made. The policy is commonly referred to as a return of premium benefit but this benefit is limited to twenty years. Normally decreasing term life insurance is taken to enable the policy holders dependents to pay off an outstanding debt that is going down.

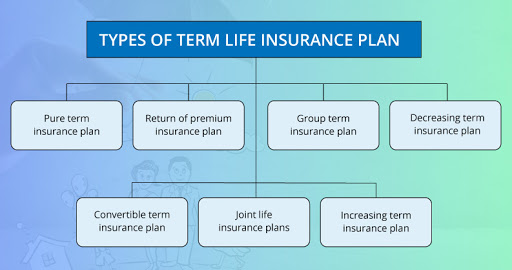

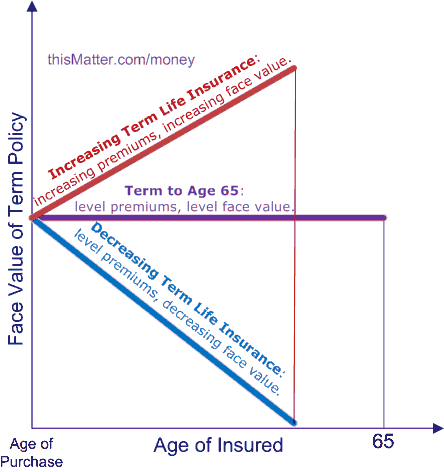

An increasing term life insurance plan helps in meeting the increased financial responsibilities by increasing your coverage steadily over time. There are several different types of life insurance plans out there. How to increase existing life insurance.

There are so many that it can often be hard to work out which one is the right one for you. Decreasing term insurance is a more affordable option than whole life or universal life insurancethe death benefit is designed to mirror the amortization schedule of a mortgage or other high. Using a needs analysis and finding out what your options are through your employer or with your current life insurance coverage can give you some options.

A life insurance policy of any kind is designed to pay out an amount of money upon the death of the policy holder. The size of the payout however depends on the type of policy as well as the unique circumstances of the policy holder. Consider the costs and what will be required to.

Indeed many mortgage lenders stipulate that life insurance must be in place at the outset of your agreement. The best part about increasing term insurance plans is that the premiums are low and affordable. As the name suggests with traditional increasing term life cover amount insured increases each year by a fixed amount for the length of the policy.

If you think you might need more life insurance youre probably right. Increasing term life insurance if you are looking for low cost comprehensive insurance then we can provide you with multiple quotes to help you find a provider you are happy with.

The Ultimate Guide To Life Insurance

The Ultimate Guide To Life Insurance

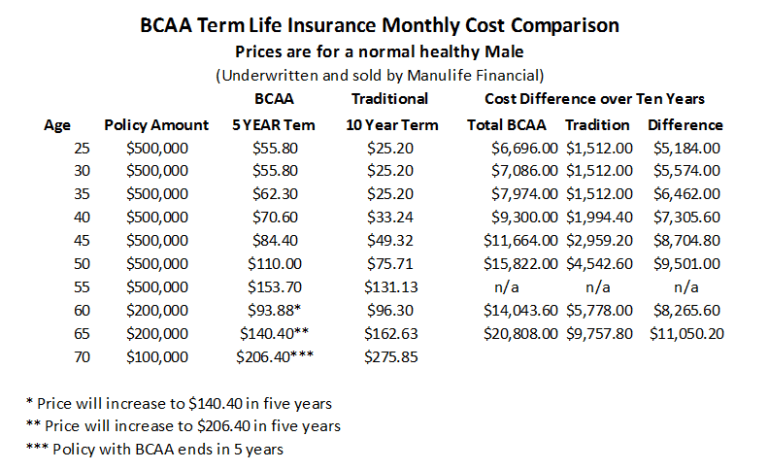

Should You Buy Bcaa Life Insurance Canada Life Insurance Quotes

Should You Buy Bcaa Life Insurance Canada Life Insurance Quotes

Term Life Insurance How It Works

Term Life Insurance How It Works

Top 7 Best Term Insurance Plans In India In 2019 2020

Top 7 Best Term Insurance Plans In India In 2019 2020

Increase Term Life Cover To Meet Your Rising Needs

Increase Term Life Cover To Meet Your Rising Needs

Term Life Insurance Definition

Term Life Insurance Definition

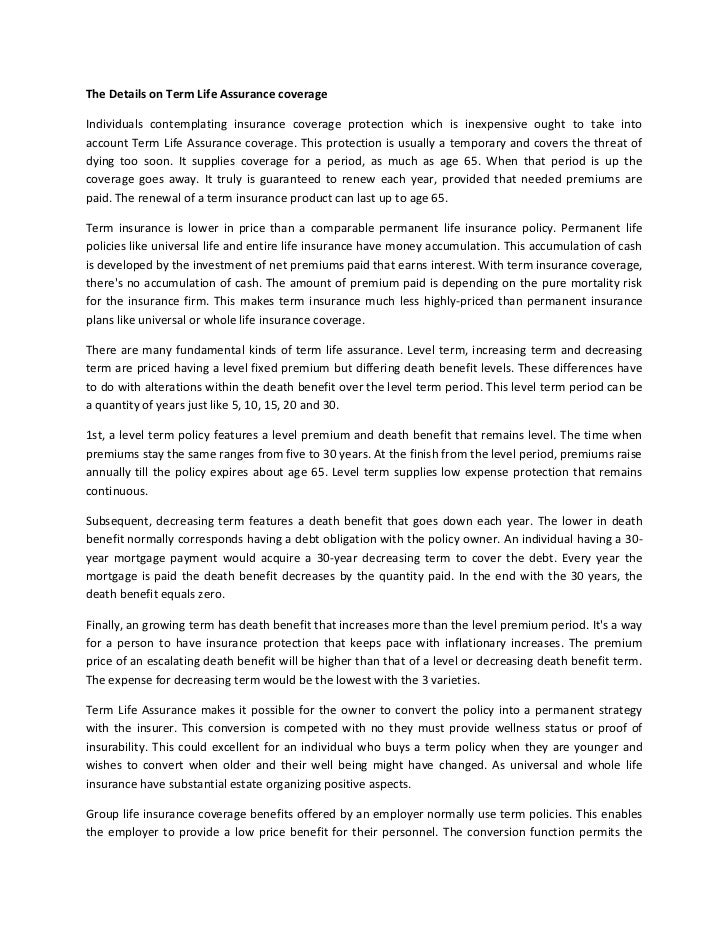

The Details On Term Life Assurance Coverage

The Details On Term Life Assurance Coverage

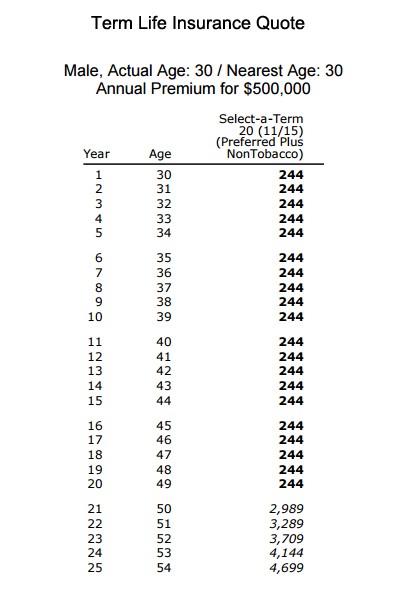

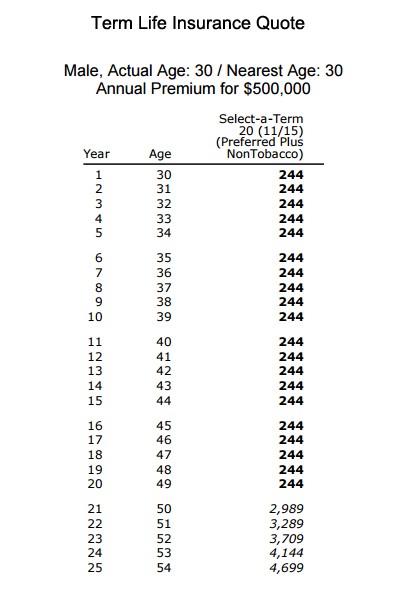

Free Printable 20 Year Term Life Insurance Quote Malloryheartcozies

Free Printable 20 Year Term Life Insurance Quote Malloryheartcozies

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

Understanding Increasing And Decreasing Term Life Insurance

Understanding Increasing And Decreasing Term Life Insurance

Life Insurance Basic Policy Types Two Basic Types Term Insurance

Life Insurance Basic Policy Types Two Basic Types Term Insurance

Unit B Personal Law Essential Standard 4 02 Understand Types Of

Unit B Personal Law Essential Standard 4 02 Understand Types Of

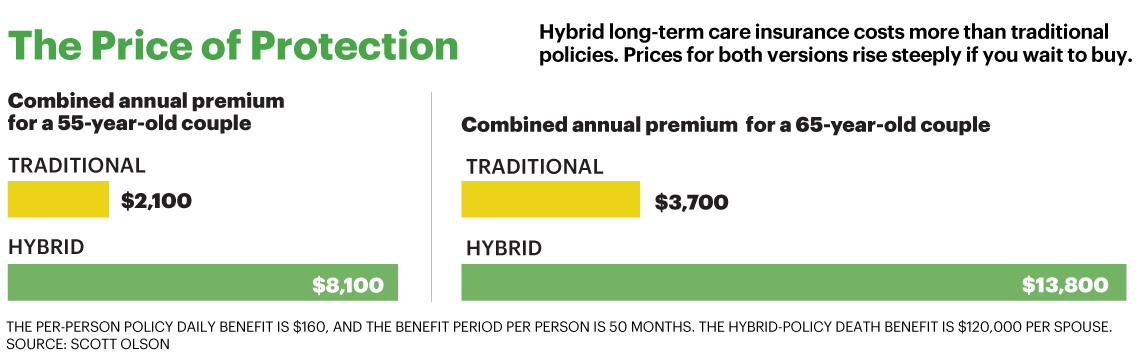

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

Save Money With Modified Coverage Life Insurance Life Ant

Save Money With Modified Coverage Life Insurance Life Ant

How To Increase Coverage With Term Life Insurance Riders Hdfc Life

How To Increase Coverage With Term Life Insurance Riders Hdfc Life

Term Insurance Coverage Claim Exclusions

Term Insurance Coverage Claim Exclusions

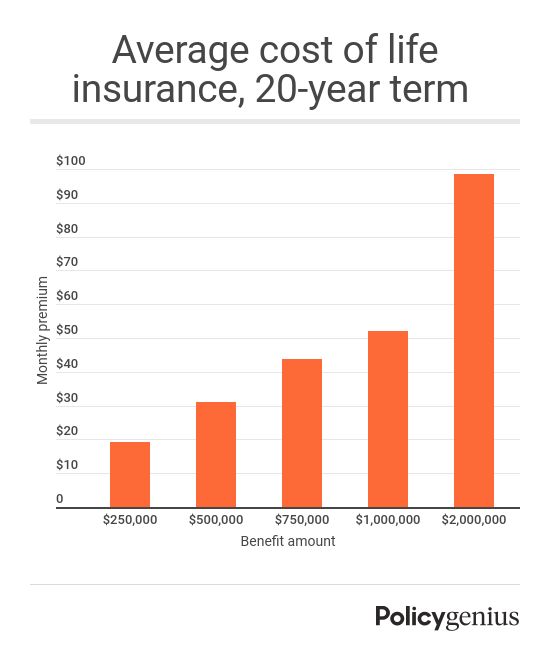

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Term Insurance What Is Term Life Insurance

Term Insurance What Is Term Life Insurance

What Is Increasing Term Life Insurance Post Office

What Is Increasing Term Life Insurance Post Office

Understand What A Term Life Insurance Really Is Success

Understand What A Term Life Insurance Really Is Success