The cost of your term life insurance is determined by four primary factorsthese factors are. With a whole life permanent policy product your premiums can be locked in and will remain the same for the entirety of the policy.

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

The cost of life insurance typically depends on the age and health of the insured.

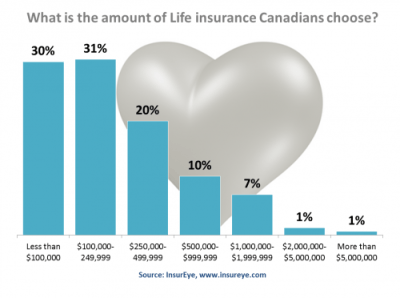

How much does permanent life insurance cost. Life insurance policies vary depending on your health age type of policy and coverage amount. On average men will pay 24 more for term life insurance than women. Is answered free by a licensed agent.

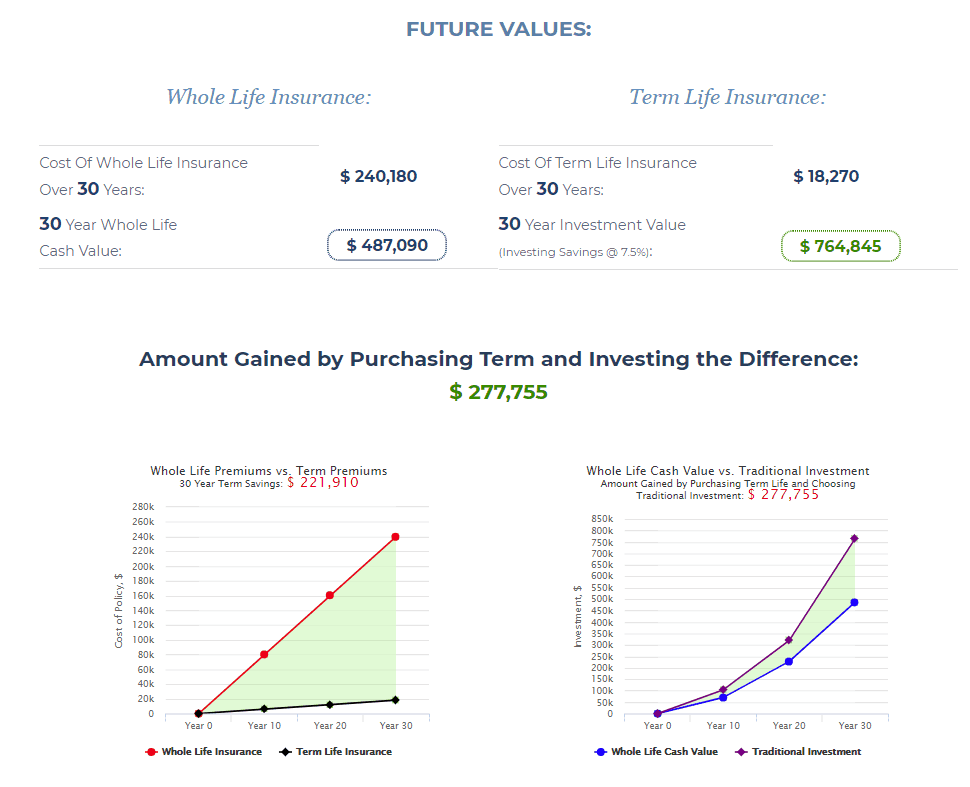

How much does permanent life cost. The cash value accumulation has a more distinct investment component than other types of permanent life insurance because it allows you to choose from a variety of investment options. See average life insurance rates for 2020 for healthy nonsmoking men and women at different ages coverage amounts.

Besides age life insurance quotes will vary depending on your gender. However you may do better with term life insurance as it has lower rates and can provide decades of coverage. Average cost of life insurance by gender.

Pay now to protect your family later. Your age your gender your health and your lifestyle. How much does permanent life insurance cost.

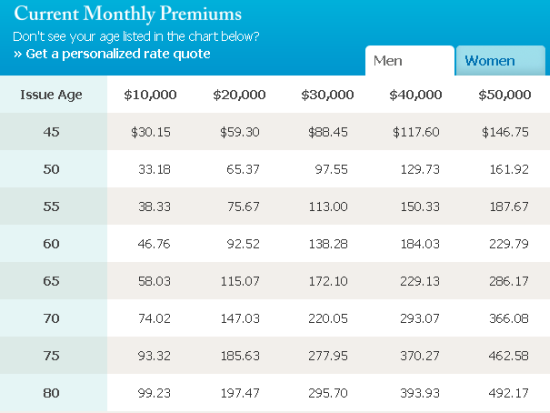

This is due to life expectancy because men tend to have a shorter life expectancy compared to women. The lower premiums will go up the older you get. Monthly rates standard non nicotine 25000 coverage.

It can range anywhere from 350 dollars per year to 1000 dollars per year. 500000 term life policy will cost about 100 more per year. Here are the top three myths about life insurance.

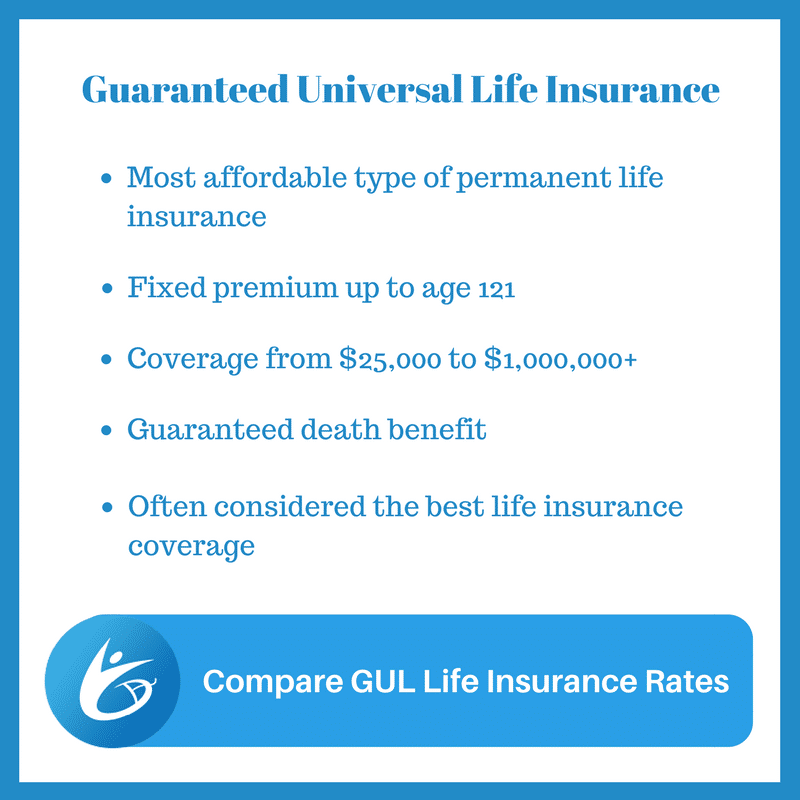

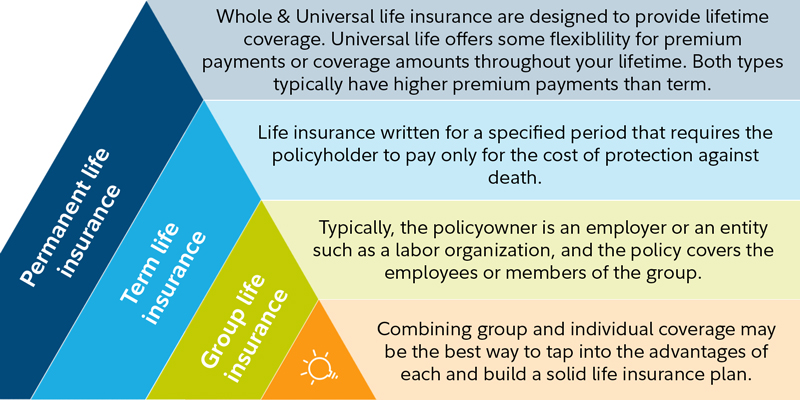

Monthly and annual universal life insurance rates how much does variable life insurance cost. Permanent life insurance policies such as whole and universal life insurance can be a great way to ensure your loved ones are financially protected. A variable life insurance policy is similar to a mutual fund.

A permanent life insurance policy is less expensive when you are young and healthy. Myths about life insurance. But it can be confusing and many people opt out of the safety net life insurance creates because they dont understand how it works as part of a financial plan.

Life insurance is too expensive. Life insurance is a simple concept. Heres a sample premium comparison chart from aaa of southern california.

Weve briefly explained each one of these factors to explain how life insurance companies determine an applicants risk and ultimately the cost of their policy.

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

The Linton Yield Method How To Compare Life Insurance Policies

The Linton Yield Method How To Compare Life Insurance Policies

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

4 Things You Should Know About Life Insurance In Canada

4 Things You Should Know About Life Insurance In Canada

Wondering If You Need Life Insurance And If So Which Type And

Wondering If You Need Life Insurance And If So Which Type And

Life Insurance Is An Important Part Of A Client S Financial Plan

Life Insurance Is An Important Part Of A Client S Financial Plan

12 Questions To Ask Before Purchasing Whole Life Insurance The

12 Questions To Ask Before Purchasing Whole Life Insurance The

Life Insurance Facts Term Life Insurance Versus Whole Life

Life Insurance Facts Term Life Insurance Versus Whole Life

:max_bytes(150000):strip_icc()/GettyImages-1083840976-a828869589624ed28316b9352c7aff11.jpg) Permanent Life Insurance Definition

Permanent Life Insurance Definition

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Permanent Life Insurance Compare Rates Term Vs Permanent Policy

Permanent Life Insurance Compare Rates Term Vs Permanent Policy

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Whole Life Cash Value Chart Parta Innovations2019 Org

Whole Life Cash Value Chart Parta Innovations2019 Org

Cheap Life Insurance Quote Having The Most For The Money

Cheap Life Insurance Quote Having The Most For The Money

15 Best Guaranteed Universal Life Insurance Companies Reviewed

15 Best Guaranteed Universal Life Insurance Companies Reviewed

Best Life Insurance Companies For 2020 The Simple Dollar

Best Life Insurance Companies For 2020 The Simple Dollar

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

4 Options To Getting Affordable Life Insurance For The Elderly

4 Options To Getting Affordable Life Insurance For The Elderly

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)