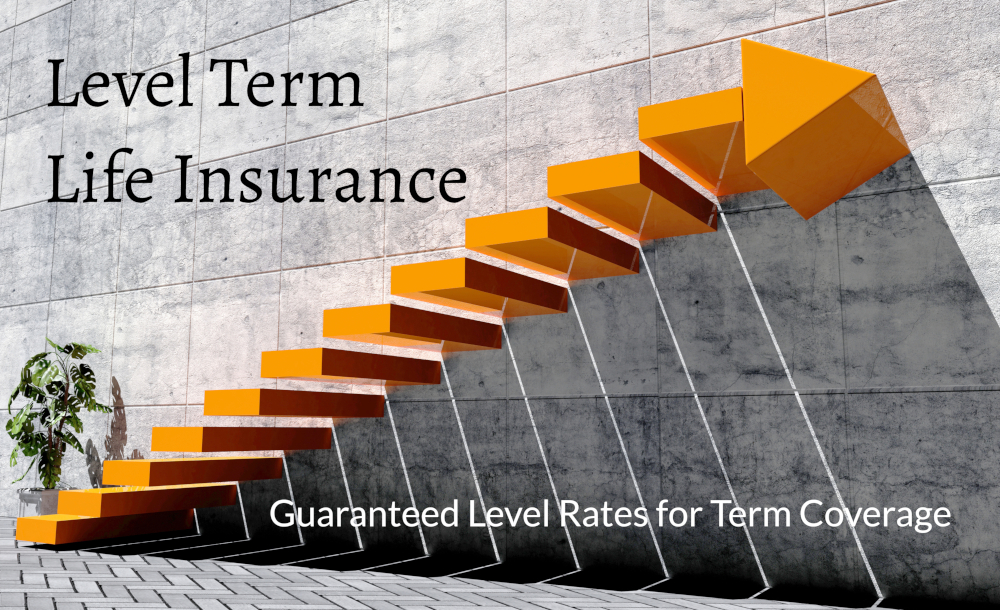

Guaranteed level term life insurance is an affordable way to get significant coverage for a set period ranging from 10 15 20 or 30 year terms. The reason we chose the top four is that they provide the most competitive rates and have an above average graded benefit clause when compared to other companies.

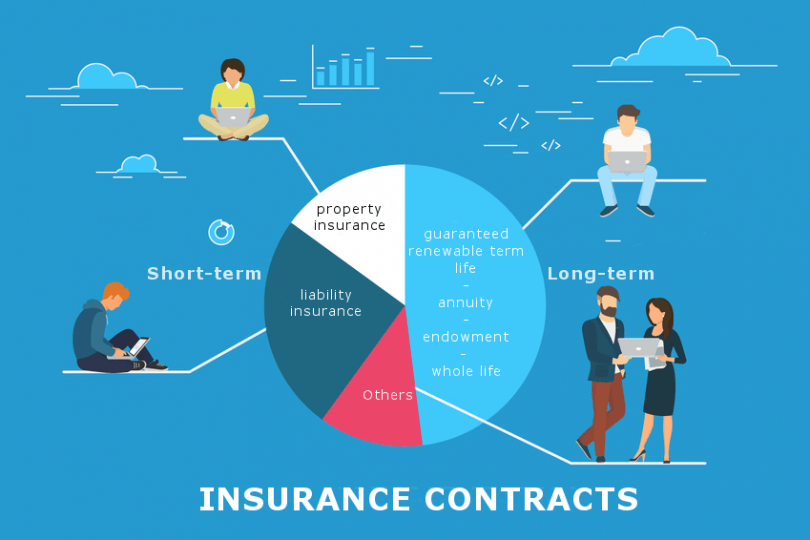

Insurance Long Duration Contracts Insurance Analyzer Info

Insurance Long Duration Contracts Insurance Analyzer Info

Guaranteed term life insurance is ideal for anyone who is struggling to get approved for traditional coverage.

Guaranteed term life insurance. There is no savings component as found in a whole life insurance product. Term life insurance average or better health age 55 or younger. Guaranteed issue life insurance policies generally come with higher premiums because the insured is older.

This means payouts and death benefits end up being lower. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. The policys purpose is to give insurance to.

What are alternatives to guaranteed issue life insurance. Our top 4 guaranteed issue life insurance companies. Term life policies have no value other than the guaranteed death benefit.

Which alternative is best for you depends on your age and your health. Guaranteed term life insurance isnt difficult to understand but most agents only ever learn about the benefits not the nuts and bolts of how it really works. Guaranteed term life insurance if you are looking for the best insurance then our insurance quotes service can give you options to find a plan you are happy with.

The best alternatives to guaranteed issue life insurance are term life insurance final expense life insurance and lastly accidental death insurance. Despite these factors it is. If the prospect of not having to submit to a medical exam or answer any health related questions appeals to you search for free quotes on guaranteed term policies through our site.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. We recognize that there are more than four companies who offer guaranteed issue life insurance policies. Guaranteed term life insurance if you are looking for insurance protection you can trust then our insurance quotes service can help you find someone you feel comfortable with.

In this article i will explain everything you need to know to give you a better understanding of guaranteed level term life insurance.

Difference Between Term Universal And Whole Life Insurance

Difference Between Term Universal And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Term Life Insurance Vs Guaranteed Universal Life Which Policy Is

Term Life Insurance Vs Guaranteed Universal Life Which Policy Is

Choices For Life Insurance With No Medical Exam

Choices For Life Insurance With No Medical Exam

Direct Purchase Term Life Insurance Comparison Which One S Best

Direct Purchase Term Life Insurance Comparison Which One S Best

Beautiful Guaranteed Term Life Insurance Quotes Best Life Quotes

Beautiful Guaranteed Term Life Insurance Quotes Best Life Quotes

Get Term Life Insurance Quotes Without Personal Information

Get Term Life Insurance Quotes Without Personal Information

How To Leave An Inheritance With Life Insurance

How To Leave An Inheritance With Life Insurance

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

Here Is Comparison Between Term Life Insurance And Permanent Life

Here Is Comparison Between Term Life Insurance And Permanent Life

What To Know Before Shopping For Guaranteed Issue Life Insurance

What To Know Before Shopping For Guaranteed Issue Life Insurance

The Pros Cons Of Guaranteed Universal Life

The Pros Cons Of Guaranteed Universal Life

What Is A Guaranteed Universal Life Gul Policy

What Is A Guaranteed Universal Life Gul Policy

Non Medical Life Insurance Purchasing Life Insurance Without An Exam

Non Medical Life Insurance Purchasing Life Insurance Without An Exam

Guaranteed Acceptance Term And Permanent Life Insurance Crowe

Guaranteed Acceptance Term And Permanent Life Insurance Crowe

Term Life Insurance Quotes And Rates

Term Life Insurance Quotes And Rates

Beautiful Guaranteed Issue Term Life Insurance Quotes Best Life

Beautiful Guaranteed Issue Term Life Insurance Quotes Best Life

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Level Term Life Insurance Guaranteed Level Rates For Term Coverage

Level Term Life Insurance Guaranteed Level Rates For Term Coverage

Guaranteed Ul Vs Traditional Ul Which Is Best

Guaranteed Ul Vs Traditional Ul Which Is Best

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar